Will you be ready for the impact ASC 606 and IFRS 15 will have on your business?

Businesses that rely on complex or recurring contracts to generate revenue should find a solution addresses the complexities of project-based businesses.

Businesses that rely on complex or recurring contracts to generate revenue should find a solution addresses the complexities of project-based businesses.

Table of Content

“Why all the fuss? These changes don’t really take effect until 2018. Plenty of time. Right?”

Wrong. If you’re a professional services firm or deal with complex contracts or recurring contracts of any kind then you definitely don’t want to take the “plenty of time” approach to ASC 606 and IFRS 15.

It is true that the new rules governing revenue recognition for contracts will go into effect for most companies in 2018. The Financial Accounting Standards Board (FASB), which administers Generally Accepted Accounting Principles in the U.S. (US-GAAP) has issued ASC 606, and the International Accounting Standards Board (IASB), which administers International Financial Reporting Standards (IFRS) used in most other countries, has issued IFRS 15. Both will enforce similar, fundamental changes to the revenue recognition process for any company that depends on complex contracts in their dealings with customers.

As you can imagine, this will include just about every business services firm from accounting to engineering, technology services and business consulting. Any organization that accepts complex contracts for projects to be delivered over a period of time will need to get their house in order. Stops there? Not at all. In today’s digital world, there are scads of hi-tech firms that sell software or other technology services on a subscription basis. Wait for it … “in the cloud”. Subscription software sales often come with recurring contracts that are structured using tiered pricing or volume discounts or routinely involve modifications, such as adding or dropping users, or that allow buyers to increase/decrease services seasonally.

The list is long and if you’re reading this post, you’re more than likely working for a company that will need to make preparations sooner than later. If so, you may want to listen to a podcast for professional services companies we hosted recently where experts from Microsoft and SBS Group discuss contract management and revenue recognition for companies using Microsoft Dynamics AX.

The bottom line is that revenue recognition has evolved into a complex and confusing set of regulations and requirements which tend to vary in practice from industry to industry and country to country. Acquiring a new single core accounting standards principle guideline is part of the FASB’s goal of converging US GAAP with International Financial Reporting Standards (IFRS). Ultimately, IFRS and US GAAP will share the same guidance on revenue recognition, substantially eliminating most differences.

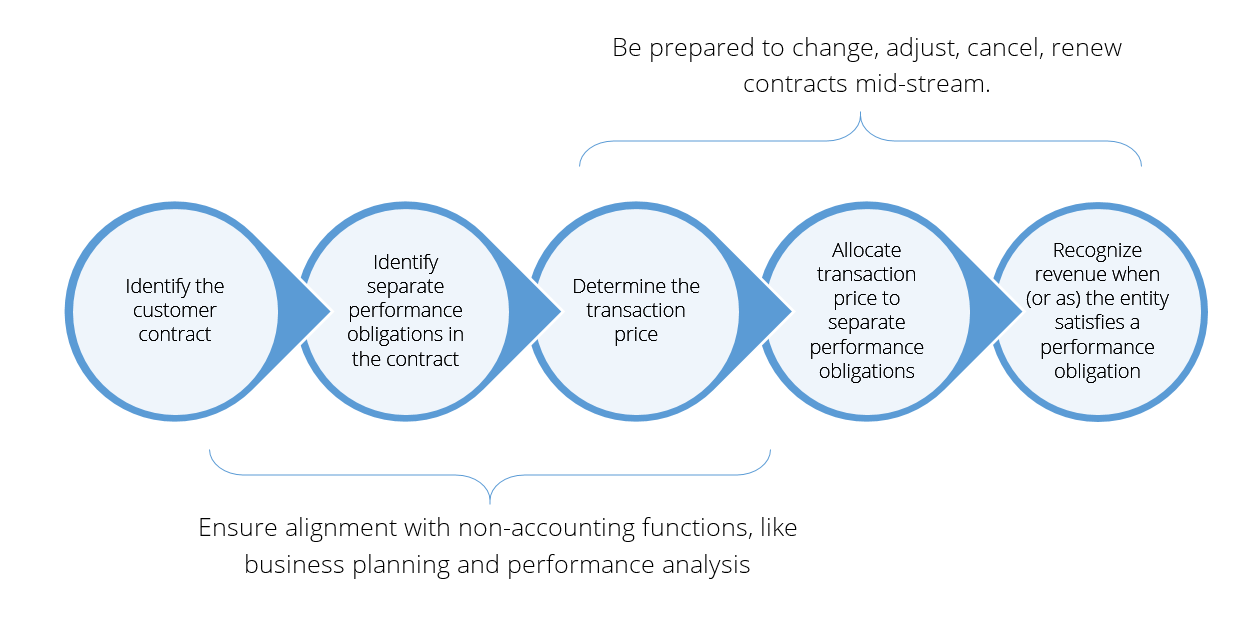

The most notable change from ASC 606 and IFRS 15 will be in how revenue (and some corresponding expenses) related to complex contracts is recognized. Meeting specific “performance obligations” will be the measure by which customers are considered to be satisfied. Only when customers are satisfied, rather than when internally measurable events occur (such as delivery, completion of milestones or the passage of time) can revenue be recognized.

Think about that for a moment. This isn’t just an accounting standards change for the bean counters in your company. This will impact everyone from sales through delivery. Why? In many firms, this will create a variance in “when” revenue happens that doesn’t necessarily align with historic performance to plans or budgets. You may sell it in January and deliver 80% of services shortly thereafter, but until the performance obligations are met…no revenue recognition. Executives will need to sort out actual-vs.-plan variances caused purely by accounting events such as a failure to receive documentation to trigger recognition, and those that reflect “real” events such as a shortfall in sales or labor overruns. Even timing of sales commissions or other incentives tied to recognized revenue will be impacted. Everyone gets to play.

The new revenue recognition accounting standards supersede most existing industry- and transaction-specific guidance. Its purpose is to improve the revenue recognition portion of financial statements and increase the consistency of financial reporting globally.

U.S. filers are expected to adopt the new accounting standards their first reporting period after December 15, 2017. However, they have the option to adopt ASC 606 one year earlier than the requirement. For most companies, financial statements released in 2018 will be the first in compliance with ASC 606. In order to ease the transition, the Boards allow filers to use practical expedients in their application of the new accounting standards and choose between two adoption methods (full- and modified-retrospective).

Regardless of deadlines set by the accounting standards boards, if you are a project-driven business or you rely on complex contracts or recurring contracts of any kind to generate revenue, the time to prepare is now. Adapting processes, updating or replacing software and updating forecasting models don’t happen overnight. Certainly not at the last minute.

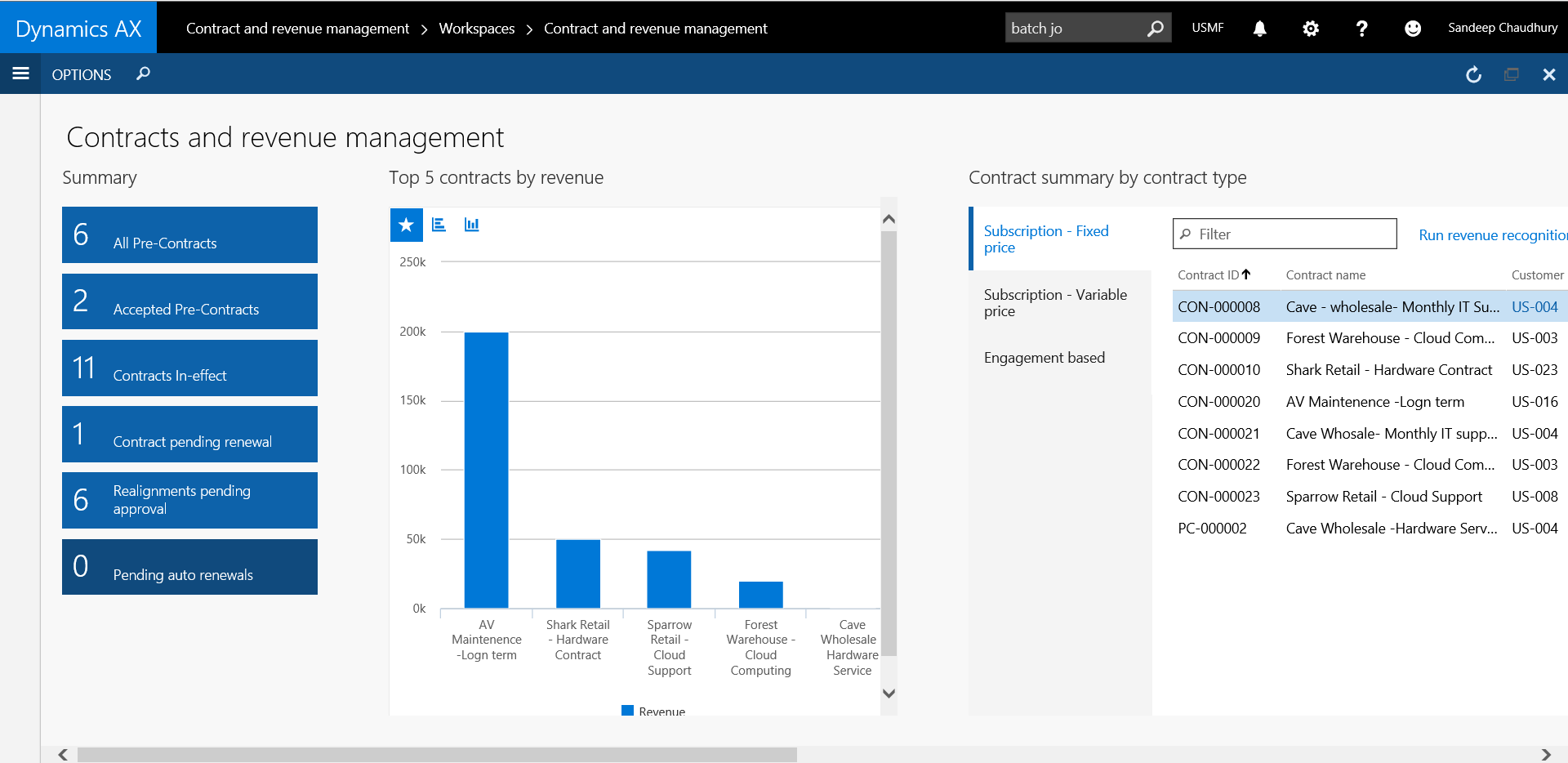

SBS Group customers leveraging our AXIO solution for Microsoft Dynamics AX already have the necessary tools in place and most will experience a smooth transition. Our solution uniquely addresses the complexities of project-based businesses. AXIO for Professional Services spans all the important processes in your firm – resource management, project management, marketing, human capital management, and financial management – to give you unparalleled insight and control of all of your critical business functions. Built on the Microsoft Dynamics AX platform, it is optimized for cloud, on premises, or hybrid deployment. Dynamics AX provides proven global scalability and enterprise-class extensibility and AXIO is compliant with all GAAP, IFRS, Sarbanes-Oxley, and DCAA requirements.

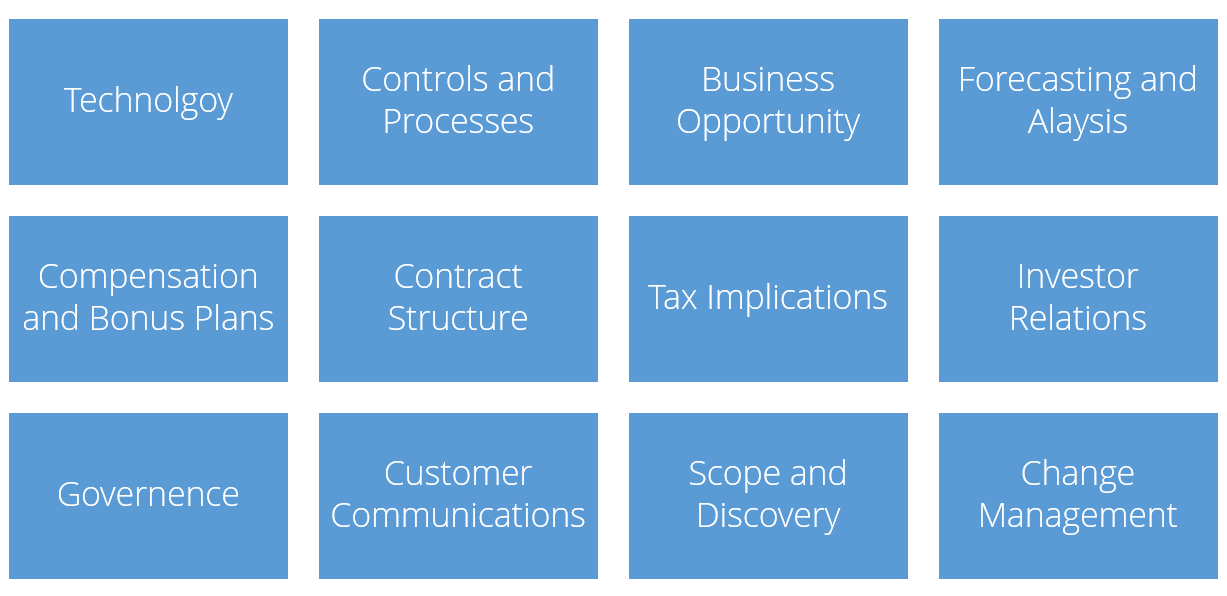

Many companies, even those with enterprise ERP and high-end forecasting tools, will need to build a plan to implement process updates and retool the development of complex contracts. Firms relying entirely on Excel or outdated planning and project management solutions may find the need to purchase and implement new software even before other processes can be adapted. It will take a comprehensive, collaborative effort to realign business planning and budgeting as your back office team adapts to these new accounting standards.

If your company is considering or currently using Microsoft Dynamics AX and would like to spend time with an accounting and technology expert from SBS to better understand the impact of ASC 606 or IFRS 15, please reach out through our website today.

Check it out yourself by attending one of our educational webcasts. Click here for webcast times and registration.

Thanks for reading and I hope you the best in your transition to the new ASC 606 and IFRS 15 standards!

Sreepathy Nagarajan

Senior Solutions Consultant

SBS Group