Modern Airports Need a Multi-Dimensional Accounting System

Modern airports require an accounting system that supports advance accounts that are absolutely critical for them. How can they do this with Dynamics 365?

Table of Content

What is a “dimension” and what is a “multi-dimensional accounting system”? A dimension is a piece of information about your business that you want to store. For example, it could be a department, a market sector, a cost center, a product code and so on. Older accounting systems used the account code to store information in segments in the account code. For example, the first segment was the actual account code, the second segment was the department code, the third segment was the market sector and so on. Typically these “segment-based” accounting systems used 3 or 4 segments in the account structure and this led to thousands of accounts in the chart of accounts, while limiting the number of analysis segments to 2 or 3 (the first segment was the account code). The modern approach is to create independent fields to store this information, and these fields are called “dimensions”. A multi-dimensional accounting system is simply an accounting system that has multiple dimensions. An example of a multi-dimensional accounting system is Microsoft Dynamics NAV.

Modern airports require their accounting system to support basic concepts of natural account organization as well as more advanced aspects of chart of account organization to support reporting requirements. The segment-based approach, unfortunately, leads to the development of complex structures of account coding with, typically, thousands of accounts in the Chart of Accounts.

A “natural” account is used to collect revenues and expenses by their type such as revenue, salaries, rent, office supplies and other expense types. These are natural accounts and a typical organization typically only requires 250 – 350 natural accounts in your Chart of Accounts to fully categorize the different elements of revenues, expenses, assets and liabilities, depending on the complexity of the business.

In addition to the natural account, an airport may also need to report by one or more organizational or responsibility units. Examples of these reporting requirements include:

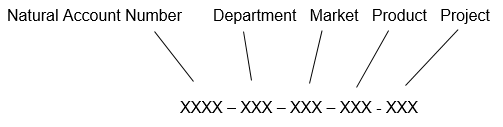

A segment-based accounting system combines the natural account with the organizational reporting segments to concatenate the codes as shown in the following example:

When a new code is created, it is linked to each account-code combination that may require this code. If a new Department is created and attached to 50 natural accounts and also has to be linked to 10 Divisions and 10 Products, this will result in the creation of 5,000 new account combinations! It is easy to see why such a system typically results in the creation of thousands of accounts in the Chart of Accounts.

The disadvantages of such a system are obvious. Apart from the complexity of maintaining thousands of accounts, the learning curve for new accounting staff is unnecessarily long. As new accounts are added, the financial reports need to be maintained and this can sometimes take a long time at month-end to update the various financial reports so they balance. Coding invoices also becomes over-complicated and prone to errors. As a result, many companies try to minimize the number of new account codes they create to try and minimize the resulting negative consequences. This leads to a reduction in the usefulness of such a structure and achieves the exact opposite of the original objective.

The modern solution to this problem is to use “dimensions” to track the “segment” codes. In the above example, there are 4 dimensions in addition to the natural account number. These dimensions are Department; Market; Product; and Project. These new accounting systems are called “multi-dimensional” and they facilitate complex reporting structures with a simple chart of accounts. Each dimension is an independent field, separate from the natural account code and the other dimensions. If a new department code is added as per the above example, just one code is added to the department dimension and no other codes are required. If an expense is entered into the accounting system, the expense can be posted to any natural account, and if that account requires the department dimension, then the department code is added when the expense is entered. The requirement for each account to require or not require a dimension is set up in the Chart of Accounts by setting a simple flag for each dimension. Once set, this structure requires little or no maintenance.

Multi-dimensional accounting systems use relational database concepts rather than the old hard-coded segment structure. As such, they are simple and yet more powerful in their reporting and analysis capabilities than the old segment-based accounting software. Any system that is simpler to use, and at the same time more powerful in its reporting capabilities, offers many advantages to the accounting staff.

The maintenance of reports in a multi-dimensional database structure is also simplified. In the above example, one new department code was added. This means one code needs to be added to the reporting structure, or, depending on the reporting software, this may be automatically picked up by the reporting software resulting in no maintenance at all.

Many organizations have a primary reporting structure, usually based on organizational lines such as Departments or Divisions. They may also require additional reporting by product line, geographic area or by market. Such diverse reporting requirements can be met by setting up different dimensions for each reporting requirement. Some systems also allow a specific dimension to be grouped in different ways to reflect the current organizational structure, for example, sales regions may be grouped one way and then re-organized a different way the following year. The ability to re-group the codes within a certain dimension provides the flexibility to do this without changing any of the underlying transactions.

Finally, having 250 to 350 natural accounts simplifies the Chart of Accounts enormously and makes it much easier to work with. New staff can learn the account numbering system in a fraction of the time, and coding invoices to the right account is also easier resulting in more accurate accounting records.

During the implementation of a multi-dimensional accounting system, the reporting requirements of the business are analyzed in order to identify the dimensions that will be needed. The dimensions are then set up and populated with codes that facilitate the reporting and analysis requirements of the business.

By implementing a new multi-dimensional accounting system like Microsoft Dynamics NAV, you will be able to improve your reporting and analysis capabilities and take advantage of powerful data visualization products like Microsoft Power BI. This is the first of five blogs on how to improve the financial management of your airport, and I will be discussing Microsoft Power BI in a future blog as well as other topics including integrating your accounting system with other airport systems; how to use key performance indicators; and cloud technology.