Financial Management: Accounting Period Close

These best practices, alerts and measures will assist in the completion of a timely period close and generation of quality financial reporting.

These best practices, alerts and measures will assist in the completion of a timely period close and generation of quality financial reporting.

Table of Content

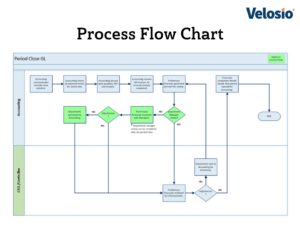

An organized and controlled GL period close is essential to the completion of accurate financial statements. Accurate statements are critical in expense control analysis and support informed financial decisions.

An accounting year is based on a number of accounting periods. Monthly accounting periods are the norm. Monthly accounting periods do not need to be based on a calendar month. In special situations, other period structures may be used.

Additionally, the accounting year does not have to be based on normal calendar month periods (January-December). Companies can start the accounting year in any month as needed. As long as there are twelve months in the accounting year, the year’s starting and ending months are irrelevant.

In order to ensure financial statement accuracy, accounting departments follow a period closing procedure to ensure that all revenue and expense transaction activity related to the reporting period, is identified and recorded accurately.

Financial reports are usually generated based on the company accounting period structure. Reporting used internally is usually generated each period. A quarterly period is used for “external” reporting (e.g. Banks, Shareholders).

Depending on the company, a preliminary set of financial statements may be generated. These statements are reviewed by a senior accounting team member (e.g. Controller). Any issues identified are communicated back to accounting, and any adjustments processed. When completed, a final set of financial statements are generated.

Measures and alerts are meant to assist the user in keeping abreast of processing status, identifying anomalies, and ensuring that implemented process controls are effectively employed. The information below illustrates the interaction between period close system functionality and measures and alerts.

Functionality: ERP GL and Sub-Ledger analysis.

Measures and Alerts:

Accounts Payable vouchers entered but not posted at period end.

Accounts Receivable invoices entered but not posted at period end.

“Revenue and expense matching” is an important accounting principle. The matching principle requires a company to report an expense on its income statement, in the same period as the related revenues.

Reviewing the period’s AP and AR transactions to be sure that they are posted helps supports this principle.

In our Analyzing Department Expense Variances post, we discussed the concept of an Accountant and Department Manager meeting during the period close, to review department expense transactions prior to generating financial statements. These meetings help to identify missing transactions.

Whether or not you use Accountant and Department Manager meetings as a part of the period close, AP and AR transactions must be reviewed to be sure that all transactions processed, applicable to the period, are finalized and posted.

Use measures and alerts to ensure that the financial statements include all of the applicable revenue and expense transactions processed.

Functionality: ERP GL, Project Accounting or standalone TE applications

Measures and Alerts:

TE entered but not posted at period end.

Travel and expenses (TE) can be entered into the company’s ERP in a number of ways. The method of entering TE activity is not important. What is important, is that they are reviewed, approved and posted into the GL. The best way to ensure compliance, is to make a TE submission cutoff date and manager review and approval, a formal part of the period close process.

A TE expense review should be a part of the Accountant and Department Manager review meeting. Again, if your company doesn’t use department expense review meetings, just be sure that a TE cutoff date and review is included as a part of the scheduled period close tasks and communicated accordingly.

Functionality: Purchase Orders and PO receiving.

Measures and Alerts:

Open purchase orders (PO) at period end.

Open PO receiving at period end.

Open POs are not recorded in the General Ledger. In most instances, the PO’s are never posted into the GL at all. The open PO review is important though, to ensure that the expenses related to the PO are included in the financial reports when warranted.

This process is completed using accruals. The Accounting Department or the Purchasing Manager reviews all open PO’s and determines which PO’s should be accrued.

The same concept applies to open PO receiving. The Accounting Department or the Purchasing Manager reviews the applicable receiving logs, or accounting system records, to identify receiving transactions which should be accrued. Sometimes, PO receiving transactions may only need to be posted, making an accrual unnecessary.

All accruals should be recorded as an auto reversing entry and prepared by Accounting.

Functionality: GL and Sub-Ledger period control.

Measures and Alerts:

GL transactions posted to a period other than the current accounting period.

Customer invoices posted to the current period with invoice dates outside of the current period.

AP vouchers posted to the current period with invoice dates outside of the current period.

Most ERPs today allow the user to process and post transactions in both prior and future accounting periods. This is very powerful tool. As such, if not properly controlled, the functionality can materially affect accurate financial reporting.

Use system permissions and security to control the functionality. Use measures and alerts to identify and correct potential issues.

This is an important review. Transactions incorrectly posted to prior and future periods, if not identified, can be very difficult to trace. A transaction incorrectly posted to a prior period and not identified and corrected, can result in having to re-run all financial statements from the period of the entry posting forward, when discovered.

Successfully implementing a new process isn’t always easy. Consider the best practices below to streamline and control new process implementations.

System permissions and security functionality play an important role in any ERP process. Using these “feature rich” ERP tools, allow the user to set up efficient and controlled processes.

A common GL period close process permissions example is displayed in the table below:

| Screen | View | New | Edit | Delete |

| Functionality | ||||

| Accounting staff | ||||

| Closing, accrual and adjusting GL journal entries. | X | X | X | NA |

| AP voucher review. | X | X | X | NA |

| AR invoice review. | X | X | X | NA |

| Open PO and receipts review. | X | X | X | NA |

| Generate financial reporting. | X | X | NA | NA |

| Complete account analyses (including bank reconciliations). | X | X | X | NA |

| Department Managers | ||||

| Review preliminary department performance reports. | X | X | X | NA |

| Create period close proposed adjustments lists. | X | X | X | NA |

| CFO, Controller or Accountant | ||||

| Preliminary financial reporting. | X | NA | NA | NA |

| Proposed period end adjustments. | X | NA | NA | NA |

| Account analysis, bank reconciliations. | X | NA | NA | NA |

| Measures/ Alerts | ||||

| CFO, Controller or Accountant | ||||

| GL transactions posted to a period other than the current accounting period. | X | NA | NA | NA |

| Customer invoices posted to the current period with invoice dates outside of the current period. | X | NA | NA | NA |

| AP vouchers posted to the current period with invoice dates outside of the current period. | X | NA | NA | NA |

| Accounts Payable vouchers entered but not posted at period end. | X | NA | NA | NA |

| Accounts Receivable invoices entered but not posted at period end. | X | NA | NA | NA |

| TE entered but not posted at period end. | X | NA | NA | NA |

| Open purchase orders at period end. | X | NA | NA | NA |

| Open PO receiving at period end. | X | NA | NA | NA |

| Department Managers | ||||

| Open PO’s and open PO receipts. | X | NA | NA | NA |

An organized accounting period close is essential to the generation of timely and accurate financial statements.

Period closing controls such as processing cutoffs, transaction review and correction, and posting or accruing transactions, when required, are key in supporting period close tasks.

Use the best practices, alerts and measures described here, to assist in the completion of a timely close and generation of quality financial reporting.