Finance Forecasting Why Budgets May Not Be Enough

Explore the dynamics of financial forecasting and budgeting, highlighting the significance of Dynamics SL in achieving accurate forecasting.

Explore the dynamics of financial forecasting and budgeting, highlighting the significance of Dynamics SL in achieving accurate forecasting.

Table of Content

Most companies today prepare some sort of financial budget. Budgets can be built at a high level (sales, cost of sales and expenses), or built in detail (sales detail by type, expenses by department, capital spending, projects). Some companies also budget the Balance Sheet to be able to prepare budgeted cashflow statements.

Budget preparation is an important task involving nearly all of the company’s management team from the department manager to senior executives.

The problem with a budget is that it’s static information. A budget can be pretty much obsolete within the first month or two of the new accounting year, making the return on the company’s budget preparation time and resource investment minimal at best.

A successful budget is one which meets four objectives:

With an annual (or even semi-annual) budget cycle, meeting these objectives is an almost impossible task. Some companies get around budgeting weaknesses by using a financial forecast.

A financial forecast is a financial projection which is periodically adjusted (usually monthly) based on actual business results and other factors.

ERP built forecasts use a number of different ERP tools such as budget functionality, multiple budgets, file import and export, advanced report writers and sometimes Excel spreadsheets.

Dynamics SL (SL) is well positioned to meet financial forecasting needs. SL offers a strong budget process that is flexible and easy to learn. SL management reports can effectively incorporate budget values in both monthly financial statements, back-up schedules and in ad-hoc reporting.

SL supports budget copying, as well as multiple budgets, which can be used inter-changeably in financial reporting as needed. SL also supports the ability to import budget values from a worksheet, or enter budget values directly into SL. A combination of both entry options can be used as needed.

Financial forecasts can be based on different calendarization methods. Forecasts are usually based on the accounting year (calendar or fiscal). For example, in a calendar year accounting environment, a forecast takes effect in the second period (February) and is re-forecasted until the end of the accounting year (December).

SL supports both calendar and fiscal accounting year structures so syncronizing the forecast to the applicable accounting year structure is not an issue.

In a financial forecast, flexible reporting is key as each accounting period’s budget or forecast value is replaced (in reporting) with actual values at the end of each period. For example, an April forecast, prepared after the March period closes (in a calendar-based accounting year), budget and forecast values for January through March are replaced with actual financial results. April through December periods would be the original budget or any re-forecasted values. When the April forecast is completed, the full year forecast report includes January-March actuals and an April to December forecast or re-forecast.

A financial forecast utilizes a number of the processes and techniques used in budgeting. The main difference between a budget and forecast relates to the information selected to appear in forecast reporting. Using the example information above, the April financial forecast report would include 3 monthly columns (or year to date) of actual results, and nine monthly columns of budget or forecast values.

SL offers a strong financial reporting tool. By using management reporter, the accounting department can easily build any forecast reports needed. As an alternative, depending on your company’s reporting needs, data needed for forecast reporting can be downloaded to Excel and accounting can accomplish forecast reporting needs in that manner.

No matter which method you use, it’s pretty easy to see how a financial forecast is a much more accurate predictor of future performance.

If you would like to learn more about financial forecasting including forward looking forecasts, See:

https://www.velosio.com/blog/replacing-budgets-with-forecasts-expect-these-benefits/

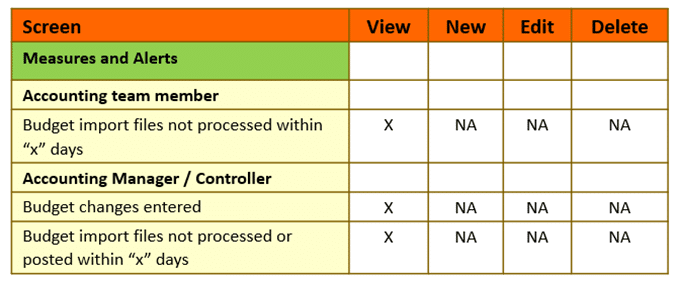

Measures and alerts are meant to assist the user in keeping abreast of processing status, identifying anomalies, and ensuring that implemented process controls are being effectively employed. The information below illustrates the interaction between budget functionality related to financial forecasting, measures and alerts.

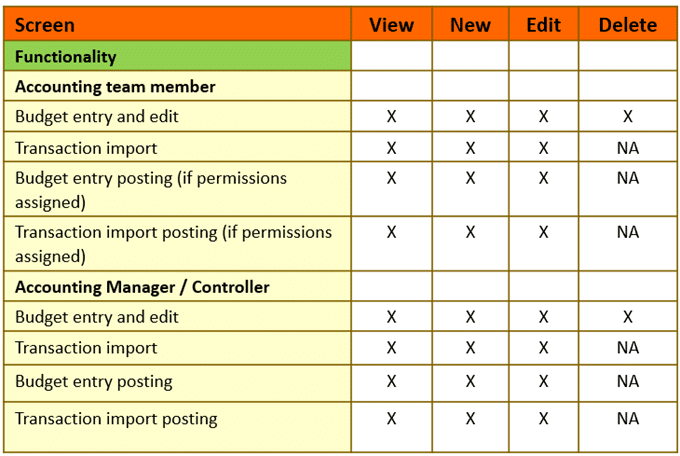

Functionality- SL multiple budget versions

Measures and Alerts-

Budget version changes

New budget versions set up

Existing budget versions disabled or deleted

Today, all ERPs support building roles and permissions to control budget version set up and budget changes. With proper permissions assigned, a user can copy a budget, rename it to a different version, then edit the new version’s budget values. Budget version control and change functionality should be tightly controlled within the accounting department. If not controlled properly, financial forecast accuracy will be negatively affected, and if significant, can render the forecast useless as an analysis tool.

For an adequate level of control, assign budget permissions, which affect financial forecasting, to a limited number of accounting users such as a senior accountant, accounting manager or the controller. Some companies have a dedicated financial reporting and analysis department that handles financial forecasting. If so, assign the permissions accordingly. Assign one user as the primary user, and the others as backups.

Forecast budget versions are no different than any other budget, the only difference being that the term “forecast budget” relates to a budget version which has been edited for use in financial forecasting.

When building accurate forecasts, using the correct forecast budget version is essential. Any new forecast budget versions built should be reviewed and their purpose in the forecasting process documented.

Specific budget versions can be deleted or set to an inactive status. Again, these budget version changes should be reviewed and documented as to their on-going purpose in the financial forecast process.

Multiple budgets and version control are an important part of the forecast process. This is particularly true if your company wants to track forecast changes from one forecast period to the next. SL supports building roles and permissions to control the budget process. With proper permissions assigned, an SL user can build a new budget, or copy an existing budget, then rename it to differentiate versions. Changes can then be imported or manually entered, to edit the new version’s values.

Functionality- SL file import

Measures and Alerts-

Budget import files not processed within “x” days

Budget import files not processed or posted within “x” days

Many companies use a set of prepared Excel worksheet templates in preparing the financial forecast files. This is an effective method when non- accounting users participate in the forecasting process. Being able to use Excel functionality, and not having to worry about understanding ERP budget functionality, simplifies the forecast process.

Using the same techniques, and probably the same worksheet templates as employed in the budgeting process, financial forecasting worksheets can be built by specific departments (e.g., HR, Payroll) and non department budget types (e.g., sales, cost of sales or depreciation expense). Using the worksheet templates allows accounting to control the GL accounts available to the forecaster.

Once the imported data is correct, the user finalizes or “posts” the applicable data.

SL processes are based on a two-step approach (import processing and import posting). This approach means that when a budget file is imported into SL, correct data is imported, incorrect data is rejected and identified in the import tool and displayed for the user to correct and re-process.

Use import functionality reporting to control the import process. By identifying financial forecast files not yet imported (as manually compared to an import control worksheet) accounting can follow up with the applicable forecasters and resolve any issues.

By identifying financial forecast files imported but not yet posted, accounting can follow up with the applicable forecasters, correct any import errors and re-process.

As a side note, if the forecast changes are not extensive, it may be easier to manually enter the budget changes into the ERP.

Successfully implementing a new process isn’t always easy. Consider the best practices below to streamline and control new process implementations.

System permissions and security functionality play a vital role in any ERP process. Using these ERP tools allows the user to set up efficient and controlled processes.

Note: Since financial forecasting uses budgeting functionality, budgeting functionality, measures and alerts examples are displayed in the tables below:

After reviewing this post, you may or may not have decided if financial forecasting is the way to go. No matter the method you choose, budgeting or forecasting, remember that some type of financial planning process is a vital part of a well-run company.

SL helps ensure budgeting and forecasting success by offering a quality budget solution. SL budgeting is a strong management tool which should not be overlooked.