Bank Account Setup and Testing

Use controlled processes and sound testing techniques to ensure that your bank account functionality is operating correctly.

Use controlled processes and sound testing techniques to ensure that your bank account functionality is operating correctly.

Table of Content

Processing bank transactions is an important company activity, as businesses receive and disburse cash and checks daily.

Accurate and controlled cash processing is valuable in determining the company’s open Accounts Receivable (AR) and expected cash receipts, Accounts Payable (AP) check processing and upcoming cash obligations and in forecasting its cash position. Accurate and timely transaction processing and reconciliation can also play a role in reducing cash loss risk.

To learn more about cash transaction processing and bank reconciliation look at Bank Transaction Processing and Reconciliation.

Setting up a new bank account should follow a controlled request and approval process. New bank account requests should be assigned to specific individuals, usually the Controller or the CFO. In smaller organizations, the request may come directly from the CEO.

Formal documentation of the new account request should be required to provide an audit trail of the account request and the subsequent bank account document review and approval processes.

While the initial review and editing of bank documents can be completed in the accounting department, the final document review and approval must be completed by an authorized signatory per the banking agreements.

Today’s ERPs offer several functionalities related to cash processing. Cash processing functionalities include streamlined cash receipt and application, electronic transaction tracking and automated bank reconciliations.

On the bank’s end, technologies such as ECS, improved lockbox functionality, positive pay and the uploading and downloading of bank account transactions between the bank systems and the customer’s ERP have improved cash transaction processing.

At the same time though, this increased interaction makes the relationship between bank systems and the ERP more complicated.

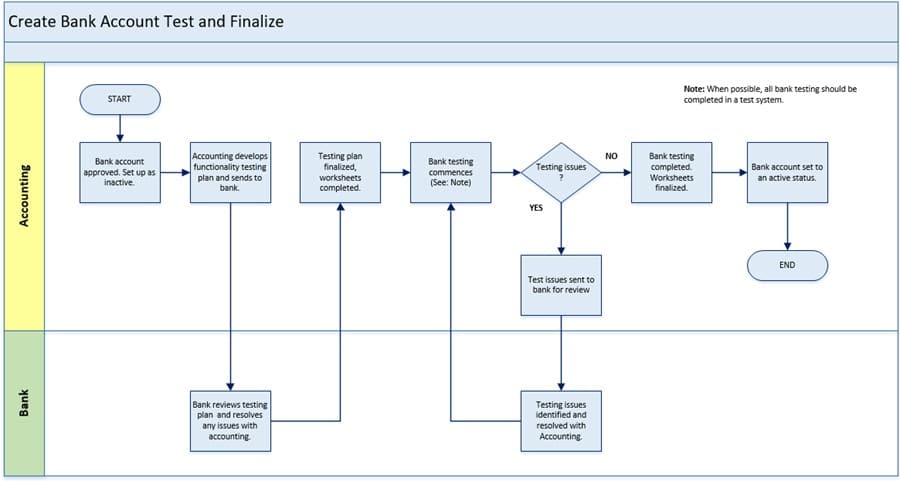

This level of complexity requires that bank account set up is supported with sound testing techniques and controlled procedures. Bank account functionality testing at the beginning of the set-up process should be completed and validated as correct before the associated bank account is set to an active status.

Banks are eager to work with their customers to ensure that all banking-related transactions are functioning properly. Use your bank relationship manager as a testing liaison resource to provide testing support as required.

Measures and alerts are meant to assist the user in keeping abreast of processing status, identifying anomalies, and ensuring that implemented process controls are effectively employed. The information below illustrates the interaction between bank setup and testing tasks, measures, and alerts.

Functionality- ERP Cash module

Measures and Alerts-

Whenever a new bank account is set up in the ERP, an alert should be sent to the Controller and CFO. An alert should also be sent to another executive team member as an additional control.

In most ERP’s, bank accounts can be set to an inactive or active status. This functionality can be used when setting up a new bank account.

The accountant sets up the bank account in the ERP then sets it to an inactive status while any “loose ends” are tied up and functionality testing is finalized. A bank account remaining inactive for a period of time can indicate an issue with the account and its associated functionalities. Choose a period of time that is appropriate for your company. I’d recommend 30 days as the basis of the alert.

The Controller or CFO should review the alert. If there are testing issues unresolved at the 30-day mark, an explanation of the remaining issues should be requested from accounting, and some additional actions may need to be taken to resolve the issues.

Functionality- ERP Cash sub-ledger

Measures and Alerts-

There should be very few transactions posted directly to the Cash GL account from sources outside of the cash module. Most cash transactions are auto posted to the GL from activities such as AP check processing, AR customer payments received and bank transaction entry or uploads.

Sometimes, GL journal entries are made in the cash GL accounts to record some type of a correction (usually a function of the bank reconciliation process). In most cases, these entries are valid.

However, the transactions may also indicate an issue with the cash account functionality itself. For example, if the bank transaction upload files contain information issues (e.g., incorrect transaction codes) or are missing any information required by the ERP, the transactions are either rejected or posted incorrectly. In either case, corrections will need to be processed. These errors are usually detected in the bank reconciliation and corrected at that time via a journal entry.

The Controller or CFO should review the alert. The reviewer in turn will ask accounting to provide an explanation of the issues identified including any transaction processing issues.

Measures and Alerts-

Timely bank reconciliations are important in effectively controlling the cash handling process. Bank reconciliations should be completed within 30 days of the period close.

Automated bank reconciliation is standard ERP functionality, so there really aren’t any excuses for reconciliations not being completed in a timely manner.

In the case of a new bank account, delinquent bank reconciliations can be an indication of processing issues delaying the reconciliation process.

Again, the alert should be reviewed by the Controller or CFO, who in turn will ask accounting to provide an explanation as to the delay and any issues identified, including any transaction processing issues.

Successfully implementing a new process is not always easy. Consider the best practices below to streamline and control bank set up and testing processes.

When using a new accountant to complete the testing, be sure to include test process training prior to commencing the test. Assign a mentor from accounting to ensure that training happens. Use the mentor to review the process as it is being completed and to function as an experienced resource as required.

System permissions and security functionality play a vital role in any ERP process including testing. Using these ERP tools allows the user to set up efficient and controlled processes.

Common bank account testing permissions examples are displayed in the table below:

| Screen | View | New | Edit | Delete |

| Functionality | ||||

| Accountant (Test system) | ||||

| Bank account set up screen | X | X | X | NA |

| Bank account transaction processing and posting | X | X | X | NA |

| ERP file upload and download | X | X | X | NA |

| Reviewers (Controller, CFO) | ||||

| Bank transaction testing worksheet | X | NA | NA | NA |

| Measures and Alerts | ||||

| Accountant | ||||

| None | ||||

| Company Executives | ||||

| New bank accounts set up (production system). | X | NA | NA | NA |

| Banks set up and not set to an active status in x days. | X | NA | NA | NA |

| Transactions posted directly to cash GL accounts from outside the cash sub-ledger. | X | NA | NA | NA |

| System bank reconciliations not completed “N” days past period end. | X | NA | NA | NA |

Processing bank transactions in a timely and accurate manner is critical in supporting cash handling internal controls and cash planning activities. Efficient and accurate processing not only supports transaction control and cash planning, but it can also be a factor in reducing cash loss.

Use the testing tools provided by the bank and your ERP to be sure that bank transactions are being processed correctly.

Remember, the basis of efficient and accurate cash processing is a correctly functioning and well tested ERP.