Use SL General Ledger Functionality to Support Basic Project Accounting Needs

Using the General Ledger is not sufficient, using a comprehensive project management solution is needed. SL offers one of the most vigorous and feature rich solution.

Table of Content

Often, there’s some confusion as to what actually constitutes project accounting. A general definition of project accounting is tracking financial transactions by specific projects. Tracking may include project costs, billings, and any associated revenue. What project accounting actually represents in a company is based on several factors including company type, project volume and company size.

For project centric companies such as consulting firms, architect and engineering firms or software publishers, project accounting is one component of several operational processes used in controlling projects, maximizing project profitability and accurately billing customers.

For project centric companies, using the General Ledger (GL) is not sufficient. A comprehensive project management solution is needed. If your company uses Dynamics SL, you’re in luck. SL offers one of the most vigorous and feature rich project management applications available in the SMB market. Many project savvy companies choose Dynamics SL as their ERP solely because of its project management functionality.

Non-project centric companies use project accounting to track internal projects such as a marketing campaign, or some type of capital improvement. These companies may decide to use a single GL account to capture project related transactions, then export the data to spreadsheets to organize and report project detail.

While this process can work for simple project accounting needs, I’m not a big fan of using non-integrated data silos. Some of the disadvantages experienced when using this approach are as follows:

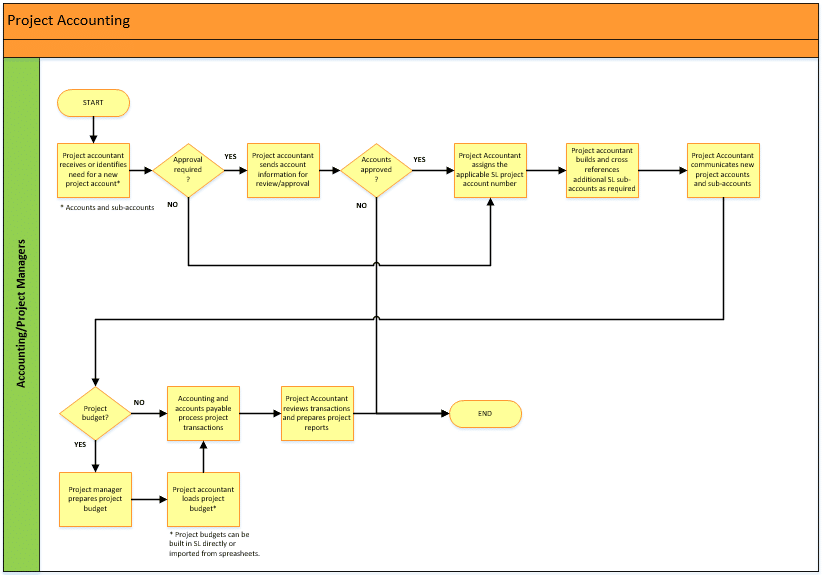

You can also elect to track project transactions directly using the SL general ledger (GL) and not rely on spreadsheets. Using the GL to track project accounting transactions can be accomplished using a set of project GL accounts and sub-accounts. In SL, accounts and sub-accounts accounts are used together to form unique combinations which can be used to classify project accounting transactions.

For example, accounting sets up a GL account representing a single project (e.g., warehouse equipment upgrade). Depending on the project, the GL account may be mapped to the Balance Sheet or Income Statement. In SL, sub-accounts are then built and combined with the GL account to capture project details. In our example, the GL project account would be warehouse equipment upgrade. Sub-accounts mapped to the project account would be sub-accounts such as engineering fees, equipment, installation etc. In SL the user can mix, and match account and sub-accounts to create combinations as needed.

As the applicable project transactions are processed, the transactions are coded to the applicable GL account and sub-account. Additional transaction details can be entered in the transaction description or in the transaction entry screen’s notes. Additionally, SL supports the use of additional data fields which can be defined by the user and displayed on the applicable screen. These fields are known as “user defined fields” and can also be used to capture project information.

Using the GL as the basis of project accounting provisions all GL features to the user including budgeting and report writers.

SL supports multiple budgets, allowing a separate project budget to be built for each project and used in project reporting. This is a powerful feature as all project information (actual and budget) are now captured in one data silo making project reporting more efficient and increasing accuracy. Uploading and downloading from spreadsheets to the GL is eliminated, as are any associated data issue corrections and reconciliations.

The project accountant can use SL management reporter’s advanced report creation features and report delivery options to ensure accurate and timely project reporting.

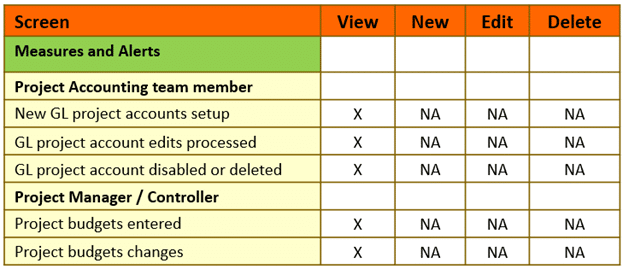

SL measures and alerts are meant to assist the user in keeping abreast of processing status, identifying anomalies, and ensuring that implemented process controls are being effectively employed. The information below illustrates the interaction between ERP GL functionality, measures and alerts.

Functionality- ERP GL Chart of Accounts

Measures and Alerts-

New GL project accounts or sub-accounts setup

GL project account or sub-account edits processed

GL project account or sub-account disabled or deleted

SL supports building roles and permissions to control GL account and sub-account maintenance and other tasks. This means that with the proper permissions assigned, a user can set up, edit, disable or even delete project GL accounts and sub-accounts. This functionality should be tightly controlled. If not used properly, it will have a negative impact on project accounts and hence on data analysis and financial reporting. Use measures and alerts to track project account and sub-account additions and changes.

For an elevated level of control, assign the permissions to an experienced user such as a senior accountant, accounting manager or the controller. Remember though, limiting permissions to a single user may be impractical as “out of office” situations can affect timely processing. An alternative approach might be to assign permissions to more than one user. Assign one user as the primary, and the another as a backup.

Functionality- ERP Budgeting

Measures and Alerts-

Project budgets entered

Project budgets changes

Project specific budgets can be prepared in addition to the financial budget. Leverage SL’s multiple budgeting functionality to create the project budget. Using a separate project budget allows accounting to use the applicable project budget in project reporting and analysis, supporting additional budget data granularity needs without impacting the financial budget.

Use measures and alerts to track new project budgets and budget changes.

Successfully implementing a new process isn’t always easy. Consider the best practices below to streamline and control new process implementations.

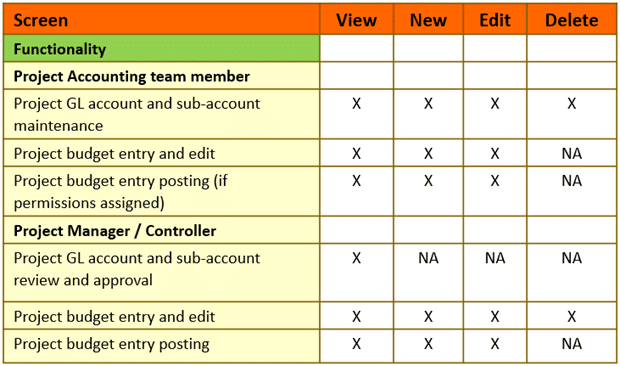

System permissions and security functionality play a vital role in any ERP process. Using these ERP tools allows the user to set up efficient and controlled processes. Common project accounting functionality, measures and alerts examples are displayed in the tables below:

Accurate project accounting is the foundation of effective project management. While the level of project accounting activity and detail is dependent on company needs, it’s critical to be able to compare actual results against a known project target in making informed project decisions.

A successful project accounting process tracks and reports project activity accurately, assists the company in controlling project spending and keeps project team members aligned.

Remember that some type of project accounting process is an important part of a well-run company, and that SL functionality can support both basic project accounting needs as well as, more complicated project management requirements.

Talk to us about how Velosio can help you realize business value faster with end-to-end solutions and cloud services.