Basic Project Accounting Using Your General Ledger

Accurate project accounting is the foundation of effective project management. Learn how this process is a crucial part of a well-run company.

Table of Content

The most general definition of project accounting would be tracking financial transactions by project including costs, billings, and revenue. What constitutes project accounting in a company is based on several factors including company type, the number of projects and company size.

For project centric companies such as Consulting Firms, Architect and Engineering Firms or Software Publishers, project accounting is one component of several operational processes used in controlling projects, maximizing project profitability, accurately billing customers and ensuring customer satisfaction. For project centric companies, the General Ledger (GL) is not sufficient. A comprehensive project management solution is needed. If your company uses Dynamics 365 BC, you may want to take a look at Progressus Software.

Non-project centric companies use project accounting to track internal projects such as a marketing campaign, or some type of capital improvement. Some companies decide to use a single GL account to capture project related transactions, then maintain spreadsheets to organize and report project detail. While this process can work for simple project accounting needs, I’m not a big fan of using non-integrated data silos. Some of the disadvantages experienced when using this approach appear below:

You can also track project transactions directly in the general ledger (GL) and not use spreadsheets.

Using the GL to track project accounting transactions can be accomplished using a set of project GL accounts and sub-accounts. The accounts are used together to classify project accounting transactions. For example, accounting sets up a GL account representing a single project (e.g., warehouse equipment upgrade). Depending on the project, the GL account may be mapped to the Balance Sheet or Income Statement.

Using this method, sub-accounts are then built beneath the GL account to capture the details. In our example, the GL project account would be warehouse equipment upgrade. Sub-accounts underneath the project account would be sub-accounts such as engineering fees, equipment, installation etc.

As the applicable project transactions are processed, accounting and accounts payable code the transactions to the applicable GL account or sub-account. Additional transaction details can be entered in the transaction description or (if the system supports it, in the transaction entry screen notes section or via “user defined screen fields”).

If your company is using an ERP such as Dynamics 365 BC, you can set up separate GL accounts and use dimensions to achieve the appropriate granularity.

Dynamics 365 BC supports a functionality known as dimensions. Dimensions can greatly reduce the number of sub-accounts needed. Dimensions are selected when processing journal entries or in the vouchering process to provide additional detail. The advent of ERP dimensions functionality is very promising. To learn more about dimensions, see the Microsoft learning website.

Using the GL as the basis of project accounting provisions all the GL features to the user including budgeting and report writers.

Since most ERPs today support multiple budgets, a separate project budget can be built for a project and used in project reporting. This is a powerful feature as all the project information is now captured in one data silo making project reporting more efficient while increasing accuracy. Uploading and downloading from the GL to spreadsheets is eliminated, as well as the associated reconciliations.

Using the ERP report writer, the project accountant can use its advanced report creation features and report delivery options.

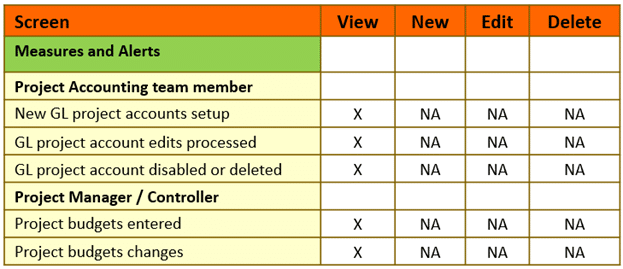

Measures and alerts are meant to assist the user in keeping abreast of processing status, identifying anomalies, and ensuring that implemented process controls are being effectively employed. The information below illustrates the interaction between ERP functionality, measures and alerts.

Functionality- ERP GL Chart of Accounts

Measures and Alerts-

New GL project accounts setup

GL project account edits processed

GL project account disabled or deleted

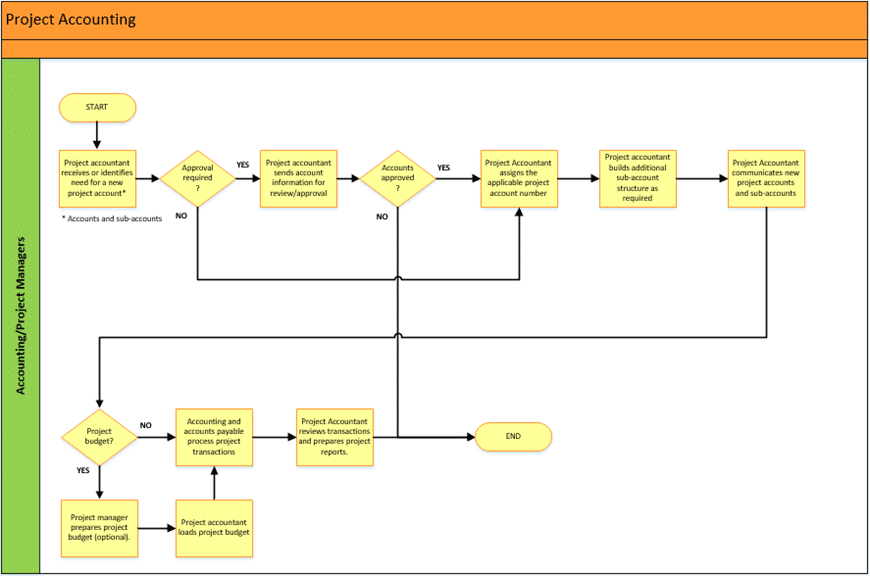

Today, all ERPs support building roles and permissions to control transaction processing and other tasks. This means that with proper permissions assigned, a user can setup, edit, disable or even delete project GL accounts. This functionality should be tightly controlled. If not used properly, it will have a negative impact on project accounts and hence on data analysis and financial reporting.

For an elevated level of control, assign COA permissions to a single user such as a senior accountant, accounting manager or the controller. Remember though, limiting permissions to a single user is impractical as “out of office” situations can affect timely processing. A better approach might be to assign permissions to more than one user. Assign one user as the primary, and the another as their backup.

Functionality- ERP Budgeting

Measures and Alerts-

Project budgets entered

Project budgets changes

Project specific budgets can be prepared in addition to the financial budget. Leverage the ERP’s multiple budgeting functionality to create the project budget. Using a separate project budget allows accounting to select the project budget in project reporting and analysis, supporting additional data granularity needs without impacting the financial budget.

Successfully implementing a new process isn’t always easy. Consider the best practices below to streamline and control new process implementations.

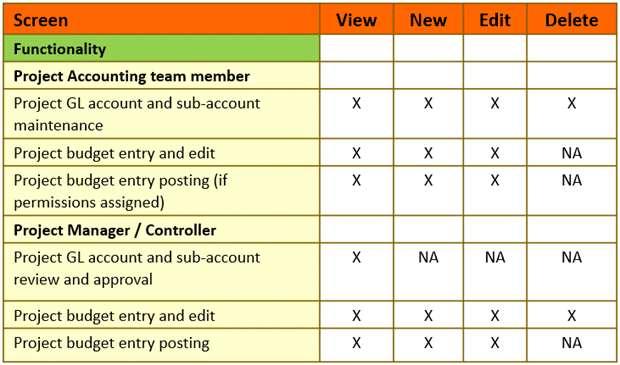

System permissions and security functionality play a vital role in any ERP process. Using these ERP tools allows the user to set up efficient and controlled processes.

Common project accounting functionality, measures and alerts examples are displayed in the tables below:

Accurate project accounting is the foundation of effective project management. While the level of project accounting activity and detail is dependent on company size and management needs, it’s critical to be able to compare actual results against a known project target in making informed project decisions.

No matter which project accounting method or level of detail you need, remember that some type of project accounting process is an important part of a well-run company.

A successful project accounting process tracks project activity accurately, assists the company in controlling project spending and keeps project team members aligned.

Talk to us about how Velosio can help you realize business value faster with end-to-end solutions and cloud services.