Accounts Payable Period Close

Enhance financial processes and streamline accounting with ERP functionality. Learn how a controlled Accounts Payable close can help ensure accurate financial statements today!

Enhance financial processes and streamline accounting with ERP functionality. Learn how a controlled Accounts Payable close can help ensure accurate financial statements today!

Table of Content

An organized and controlled GL period close is essential to the completion of accurate financial statements. Accurate statements are critical in expense control analysis and support informed financial decisions.

An accounting year is based on a number of accounting periods. Though monthly accounting periods are usually the norm, accounting periods do not need to be based on a calendar month or year. In special situations, other period structures may be used.

To ensure financial statement accuracy and that all transactions are included, accounting departments (including accounts payable) follow a pre-planned period closing procedure to ensure that all transaction activity related to the reporting period, is identified and recorded accurately.

To learn more about the GL period close process see: Financial Management: Accounting Period Close

“Revenue and expense matching” is an important accounting principle. The matching principle requires a company to report an expense on its income statement, in the same period as the related revenues. This requirement makes accounts payable (AP) a key part of the GL closing process as most of the company’s expenses are processed through AP.

It’s very important to be sure that all AP processing has been completed before closing the period. Accounts payable team members review all vendor invoices related to the period being closed, and either voucher them into the AP module, or accrue the invoices using the GL reversing journal entry function.

Additionally, as a part of the period GL close the accountant and department manager meet to review department expense transactions (processed and expected) prior to generating financial statements. These meetings help to identify expense-related transactions which need to be included.

If you’d like to learn more about this topic, see: How to Control Expense and Support Manager Accountability

If the company uses purchase orders (PO), open POs are reviewed, and accruals prepared. This process accounts for any purchases the company has made during the period for which a vendor invoice has not yet been received.

All AP accruals are entered into the GL as reversing journal entries.

Note: Purchasing period close activity will be discussed in a subsequent post. For your convenience, purchasing tasks are included in the AP close process flow chart at the end of this post.

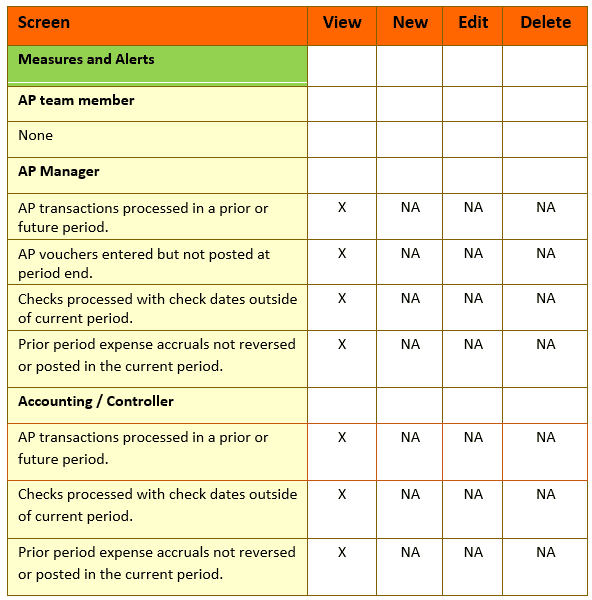

Measures and alerts are meant to assist the user in keeping abreast of processing status, identifying anomalies, and ensuring that implemented process controls are being effectively employed. The information below illustrates the interaction between AP close functionality, measures and alerts.

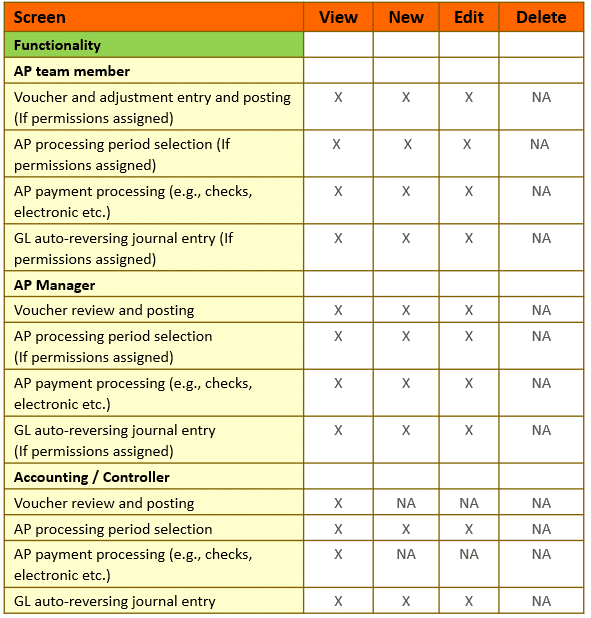

Functionality- ERP GL and Accounts Payable period controls

Measures and Alerts- AP transactions processed in a prior or future period.

Today, all ERPs support a multi-period processing functionality. This means that with proper permissions assigned the user can process transactions in a prior, current or future period. This functionality should be tightly controlled. If not used properly, it can have a negative impact on financial reporting. Reviewing AP transactions posted to a period other than the period being closed, is an important control to ensure that all AP transactions are processed correctly. The AP manager or controller reviews this alert and addresses any issues identified.

Functionality- ERP Accounts Payable voucher entry and posting

Measures and Alerts- Accounts Payable vouchers entered but not posted at period end.

AP voucher and adjustment entry is a two-step process, voucher entry and posting. Some systems allow the user to enter and post the transaction at the same time. While this process speeds up processing, many companies don’t like it as it may not provide for proper review and approval. In companies using two step processing, the AP manager reviews all the unposted AP activity, resolves any issues and posts the transactions into the proper period.

Functionality- ERP Accounts Payable payment processing and posting

Measures and Alerts- Checks processed with check dates outside of the current period.

Post dated checks are supported in most ERPs. While a post-dated check is not necessarily a processing issue, all post-dated checks should be reviewed by the AP manager or the controller. While the voucher posting records the expense portion of the transaction into the GL, post dated checks should be reviewed to be sure that there are no errors and that the effect of the post-dated check is accounted for in cash planning forecasts.

Functionality- ERP GL journal entry processing

Measures and Alerts- Prior period expense accruals not reversed or posted in the current period.

Reversing GL entries is usually a two-step process. While the ERP auto-creates the reversing entry, the entry itself usually needs to be reviewed and posted. This task is completed by the accounting department as a part of their period closing account analysis. Not posting reversing accrual entries will cause the ERP to duplicate the expense when the corresponding voucher is processed and posted.

Successfully implementing a new process isn’t always easy. Consider the best practices below to streamline and control new process implementations.

System permissions and security functionality play a vital role in any ERP process. Using these ERP tools, allow the user to set up efficient and controlled processes.

Common AP period close functionality, measures and alerts examples are displayed in the tables below:

An organized and controlled GL period close is essential to the completion of accurate financial statements. Accurate statements are critical in expense control analysis and support informed financial decisions.

The AP department plays an important role in the period close process. AP closing controls such as processing cutoffs, transaction review and correction, and posting or accruing AP transactions, when required, are key in supporting period close success.

Use the functionality, best practices, measures and alerts described here to assist in the completion of a timely close and generation of quality financial reporting.

Talk to us about how Velosio can help you realize business value faster with end-to-end solutions and cloud services.