Dynamics Business Central vs. Finance: Choosing the Right ERP for Your Organization

Compare Microsoft Dynamics Business Central vs Finance & Operations. Discover the key differences to assist in your ERP selection process.

Table of Content

Choosing the right Microsoft Dynamics 365 (D365) ERP solution is a tough decision. It involves more than just comparing Dynamics 365 Business Central (BC) and Dynamics 365 Finance & Supply Chain (formerly, Finance and Operations (F&O). Many people often view Business Central as the best choice for small and medium-sized businesses. Larger, more complex organizations prefer F&O. However, the situation is more complicated than it seems.

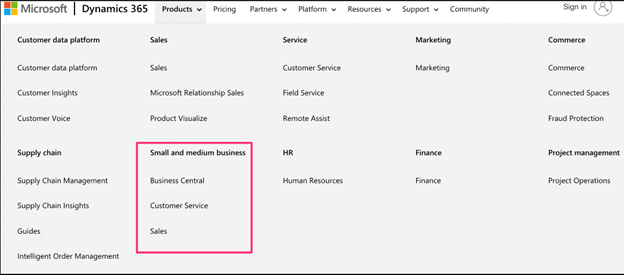

Before we dig in, let’s discuss the Dynamics 365 modules and how they’re presented to prospective buyers. A bit of confusion exists, particularly for decision-makers that just started evaluating their ERP options. This screenshot of the current D365 product lineup that helps put things in perspective.

The red box represents Dynamics 365 BC and its supported add-on modules (the SMB or “Professional” option). Everything outside that box falls into the “Enterprise” category.

The red box represents Dynamics 365 BC and its supported add-on modules (the SMB or “Professional” option). Everything outside that box falls into the “Enterprise” category.

The Enterprise modules offer much more than just Finance and Supply Chain Management (F&SCM). These are often seen as a separate solution.

That said, here’s a basic breakdown of each option.

Dynamics Business Central is the only all-in-one solution of the D365 bunch.

It works with other Microsoft Apps and ISV solutions. However, it can also serve as a standalone ERP that connects the whole business. Inside, you’ll find the following modules:

Ideal for: Small to medium-sized businesses in professional services, manufacturing, or distribution. Business Central is particularly suited for single-country operations, simpler processes, and organizations transitioning from tools like QuickBooks or legacy systems.

Considerations: BC offers robust functionality but may require ISV solutions and manual configurations for complex needs. It supports fewer than 200 users, making it ideal for smaller operations.

If you are thinking about using Dynamics 365 Business Central as your new ERP solution, take our ClearPath assessment. This will help you see if this solution is the right fit for you.

Unlike Dynamics 365 Business Central, Finance & Operations – now Dynamics 365 Finance — isn’t a standalone ERP.

Finance and Supply Chain Management are separate modules that form part of a customizable Enterprise ERP. Users can also add other modules like HR, Sales, and Commerce for a complete solution. They can also include add-ons such as Guides, Fraud Protection, and Connected Spaces.

Compared to Dynamics Business Central, the features for large businesses are more advanced. They support the needs of a growing company. Better integration and built-in AI help organizations improve and speed up all business processes.

Ideal for: Large enterprises, multi-national organizations, or companies with complex supply chain and finance needs. This design serves businesses that require advanced automation, scalability, and global operations.

Choosing between Business Central and Finance and Operations requires a holistic evaluation of your business model, operational complexity, and growth strategy. Below are some critical considerations:

Business Central works well for professional services, manufacturing, and distribution sectors.

F&SCM supports industries with more demanding needs, such as retail, public sector, and global supply chains.

“Corporate revenue and growth projections are among the top factors used to determine whether it makes sense to use Finance and Supply Chain Management, versus Business Central.” – Robbie Morrison, CEO

Both Business Central and Finance and Operations leverage AI and automation to streamline operations, but their capabilities align with different organizational needs.

Out-of-the-box, BC provides AI-powered features that optimize business processes:

BC users also gain a free Power BI license for reporting and insights. You can embed reports in BC for easy access. Advanced dashboards are available through the Power BI Desktop or web app. Users can further extend capabilities by upgrading to Power BI Pro.

Dynamics 365 Finance and Operations offers advanced, embedded AI and predictive analytics for enterprise-level needs:

By using AI and automation, F&SCM offers better insights and more scalability for complex operations. At the same time, BC provides efficient tools designed for growing small and medium-sized businesses (SMBs).

Business Central works well with Microsoft tools like Teams, Outlook, Excel, and Power Platform. This makes it easy to manage tasks and automate workflows. You can use features like approval flows, content posting, and task creation using BC’s native Workflows tool.

For more advanced automation, you can use Power Automate, but it requires extra setup. These capabilities make BC ideal for SMBs looking to optimize processes without heavy customization.

Finance and Operations offers deeper, enterprise-level automation with embedded AI and machine learning. Finance automates tasks such as vendor invoicing, fraud prevention, and cash flow management. Supply Chain uses real-time insights to improve production, enhance quality, and cut waste. Advanced tools like robotic process automation (RPA) and Lifecycle Services (LCS) further enhance implementation, monitoring, and scalability for complex operations.

All Dynamics 365 core ERP and CRM modules are priced on a per user, per month basis.

Again, Business Central is a standalone module, which makes it a bit easier to calculate monthly subscription costs. Add-on modules like Customer Service Professional or Sales Professional, of course, increase that monthly expense.

Estimating total spending on an Enterprise plan isn’t as straightforward.

One of the key advantages of Microsoft Dynamics 365 is that you can build your own ERP from a selection of pre-built modules. Then from there, they can customize it further so it aligns with your exact business needs.

But that flexibility is a double-edged sword. If you’re not careful, you can easily overspend on customizations or licenses. Some users may only need access to one or two modules.

“As an example, we’ll look at the number of ISV solutions a client needs to add to BC to cover all business requirements. At a certain point, F&O becomes the better choice, offering more functionality straight from the box.” Robbie Morrison, Velosio CEO

Dynamics 365 Enterprise implementations are more costly and complex than Business Central–and they take a lot longer.

You should look at the whole picture. This includes total cost of ownership, cloud readiness, ISVs, add-on subscriptions, and infrastructure upgrades. Think about these factors before choosing a solution.

Implementation partners play an essential role in evaluating the total cost of implementing and maintaining D365.

Many offer proprietary solutions that speed up implementation and extend the value of existing features. And–they can help organizations navigate the selection process so they can maximize the value of their ERP investment.

| Feature | Dynamics 365 Business Central | Dynamics 365 Finance |

|---|---|---|

| Capabilities | Core financials (GL, AP, AR, cash flow, intercompany transactions), lite inventory, warehousing, basic manufacturing. | Advanced analytical accounting, multi-entity and multi-currency accounting, advanced supply chain management and planning, robust manufacturing and distribution capabilities. |

| Pricing | Starts at $70/user/month (Essentials), $100/user/month (Premium). | Starts at $210/user/month (base), $300/user/month (premium), plus add-ons like Supply Chain Management ($30/user/month). |

| Licensing | Essential, Premium, Team Member, External Accountant licenses. Read-only access via Microsoft 365 licenses. | Full user, Operations Activity, Team Member, Device licenses. |

| Scaling | Suitable for stable growth, limited to smaller operations. | Designed for rapid growth and large-scale operations. |

| Customization | Easier customization and configuration via extensions, simpler cost estimations. May require add-ons for advanced functionality. | More complex customization due to modularity, higher potential costs, but offers unmatched flexibility and scalability. |

| Total Cost of Ownership | Lower TCO compared to Finance. | Higher TCO due to licensing, implementation complexity, and ongoing maintenance. |

| Implementation | Faster and less complex implementation, typically costing between $100,000-$500,000. | More complex and time-consuming implementation, often costing between $750,000-$5 million. |

| User Training | Simpler training through various methods. | More extensive training required, often with ongoing maintenance needs. |

| Automation | Native workflows, integration with Power Automate (with additional setup). | Deeper, enterprise-level automation with embedded AI, machine learning, RPA, and Lifecycle Services (LCS). |

| Industry Focus | Professional services, manufacturing, distribution. | Retail, public sector, global supply chains, and other industries with complex needs. |

| Built-in Intelligence | Basic AI-powered features for account reconciliation, inventory forecasting, sales data syncing, and Power BI integration. | Advanced, embedded AI and predictive analytics for real-time financial performance monitoring, cash flow forecasting, supply chain insights, and disruption prevention. |

Still weighing the pros and cons of Dynamics 365 Finance vs. Business Central? Get our quick-reference guide to compare features, integration and scalability — side by side.

In the end, you need to choose between Dynamics 365 Business Central vs Dynamics 365 Finance and Operations. You should base your decision on your business needs. Consider the complexity of your operations and your goals. While Business Central provides an affordable, all-in-one ERP solution for SMBs, F&SCM offers unparalleled flexibility and intelligence for enterprises managing global operations. If you are looking at ERP solutions and need help, Velosio can assist you. We can help you evaluate options, customize modules, and implement a Dynamics 365 solution. As a top 1% Microsoft partner, we specialize in delivering ERP solutions tailored to your business needs.

What’s the primary difference between Dynamics 365 Business Central and Finance and Supply Chain Management (F&SCM)?

Business Central is an all-in-one ERP solution designed for small to medium-sized businesses with simpler processes. F&SCM, on the other hand, is a modular, enterprise-grade ERP built for larger organizations with complex finance and supply chain needs.

How do I decide whether Business Central or F&SCM is right for my business?

Consider factors like business size, operational complexity, growth projections, and budget. BC is ideal for SMBs with straightforward workflows, while F&SCM is better suited for enterprises with global operations, high transaction volumes, or advanced automation needs.

What are the implementation and cost differences between Business Central and F&SCM?

Business Central is typically faster and more affordable to implement, but may require add-ons for advanced functionality. F&SCM offers greater flexibility and scalability but involves a longer, more complex implementation process with higher upfront costs.

Talk to us about how Velosio can help you realize business value faster with end-to-end solutions and cloud services.