How to Build and Maintain an Effective Budget Using Dynamics SL

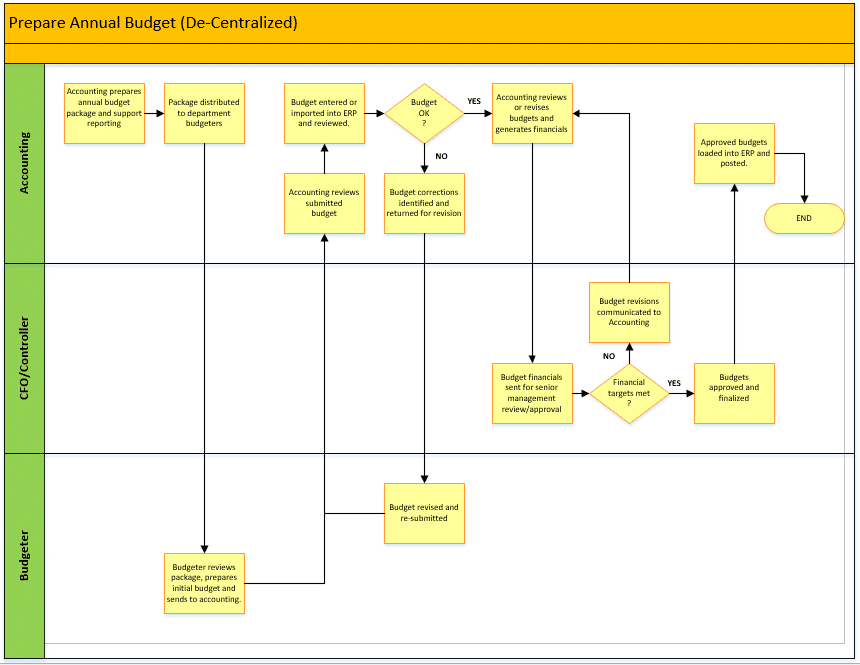

In this post, we’ll discuss how to build a budget using the decentralized process, and Dynamics SL.

In this post, we’ll discuss how to build a budget using the decentralized process, and Dynamics SL.

Table of Content

An accurate budget is the basis of effective business management. Today, most companies prepare a financial budget. Some build budgets at an extremely high level (e.g., sales, cost of sales and expenses), others build a detailed budget (e.g., sales detail by type, expenses by department, capital spending, projects). Companies may also budget the Balance Sheet to be able to prepare budgeted cashflow statements. The level of budget detail and complexity is dependent on company size, corporate requirements or management style.

Budget preparation ranges from the executive team determining the budget and disseminating it to the company’s team members. This is known as top down, or centralized budgeting. Budgets can also be built by the executive team providing general budget targets then letting each department manager build a budget for their area of responsibility. The department budgets are then consolidated up to the company level. This method is called decentralized budgeting.

In addition to entering budget financial values, many ERPs offer the ability to set up “non-financial or non-posting” accounts in the general ledger.

These accounts function only as repositories to capture non-financial information (e.g., headcount or real estate square footage). Entries into these accounts are not subject to normal DR/CR balance requirements. This functionality can be used in the budgeting process and the values included in budget reporting as required. Dynamics SL (SL) supports the use of nonfinancial accounts. In budgeting for example, they can be used to track headcount changes during the year and used to provide additional insight into salary and fringe benefit budget report values. This ability allows the budgeter to display essential information in budget reporting without having to rely on numerous sub-schedules, streamlining the reporting process.

SL offers a strong budget functionality. The SL budgeting process is flexible and easy to learn. SL management reports can effectively incorporate budget values in both monthly financial statements, back-up schedules and in ad-hoc reporting. SL supports multiple budgets, which can be used interchangeably in financial reporting as needed.

SL also supports the ability to import budget values from a worksheet, or enter budget values directly into SL. A combination of both entry options can be used as needed.

Importing the bulk of budget values from an Excel spreadsheet, and using direct entry for corrections and adjustments, is the predominant method used in most companies.

The SL transaction import processor makes importing data files into the budget module a very efficient and straightforward process. File import controls related to error identification and data correction handling ensure that imported data files are “clean” and accurate before being posted.

A successful budget meets four objectives:

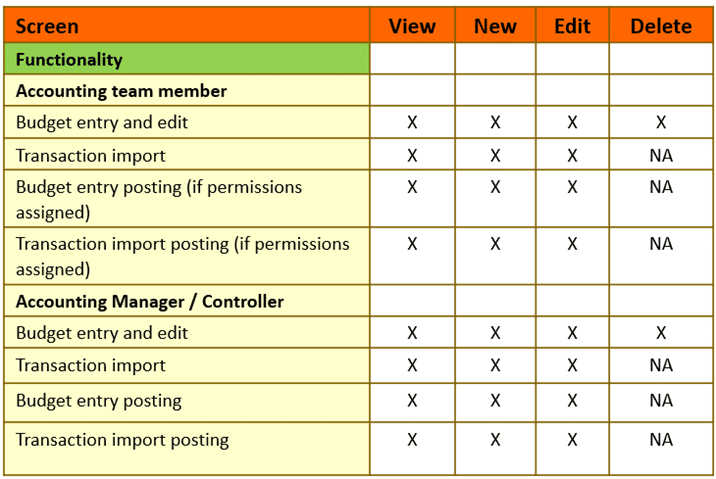

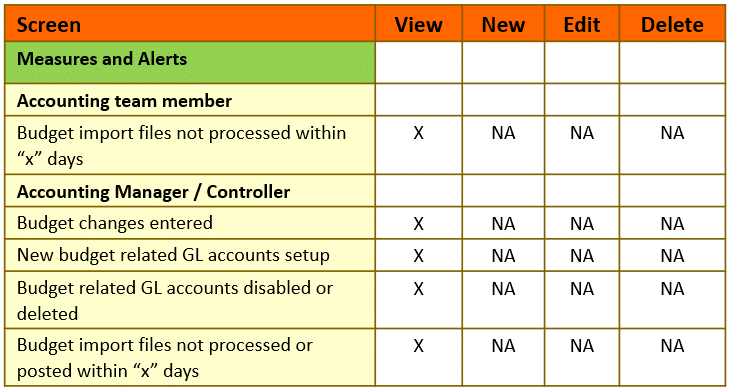

Measures and alerts are meant to assist the user in keeping abreast of processing status, identifying anomalies, and ensuring that implemented process controls are being effectively employed. The information below illustrates the interaction between SL budgeting functionality, measures and alerts.

Functionality- SL budgeting

Measures and Alerts-

Budget changes entered

New budget related GL accounts setup

Budget-related GL accounts disabled or deleted

SL supports building roles and permissions to control budget transaction processing. With proper permissions assigned, a user can import, enter, change, re-class or delete budget values.

Budget change functionality should be tightly controlled within the accounting department. If not controlled properly, budget changes will have a negative impact on budget accuracy and if significant, can render the budget useless.

For an adequate level of control, assign budget permissions (including budget changes) to a limited number of accounting users such as a senior accountant, accounting manager or the controller. Assign one user as the primary user, and the others as backups.

A budget-related GL account is no different than any other GL account, the only difference being that the term relates to a GL account that would normally be budgeted (e.g., sales, cost of sales or expenses such as rent or office supplies).

When setting up a new budget-related GL account, the budget should be reviewed to determine if an adjustment, such as a budget amount re-class or additional budget entries is required.

Changes to budget-related accounts need to be monitored so that the change can be reflected in the budget. For example, if a budget-related GL account is disabled or deleted, the budget should be adjusted accordingly.

Functionality- SL budget import

Measures and Alerts-

Budget import files not processed within “x” days

Budget import files not processed or posted within “x” days

Many companies use a set of prepared Excel worksheet templates in preparing the company budget. This is an effective method as budgeters are familiar with Excel functionality, and by using Excel, do not need to worry about understanding SL budget functionality.

Additionally, using worksheets allows accounting to control budget data entry ensuring that the budget import process is accurate and efficient. For example, accounting can build and distribute budget worksheets by specific departments (e.g., HR, Payroll) and non-department budget types (e.g., sales, cost of sales or depreciation expense). Building the worksheets in this manner allows accounting to control the GL accounts available to the budgeter.

By “locking” worksheet rows and columns accounting can also prevent the user from entering new accounts, which are not authorized. Since most budget import issues revolve around incorrect GL accounts, these controls can go a long way toward making the import process more efficient.

SL import processes are based on a two-step approach (import processing and import posting). This approach means that when a budget file is imported into SL, correct data is imported, and incorrect data is rejected and identified in the import tool and displayed for the user to correct and re-process.

Once the imported data is correct, the user can then finalize or “post” the applicable data.

Budgets are rarely imported in total as the resulting files will be large and unwieldy to handle. Usually, the budgets are imported by department or non-department budget type. This allows accounting to more easily review the import file, identify errors and correct the issues accordingly.

Use SL import functionality reporting to control the import process. By identifying budget files not yet imported (as manually compared to a budget import control worksheet) accounting can follow up with the applicable budgeters and resolve any issues.

By identifying budget files imported but not yet posted, accounting can follow up with the applicable budgeters and correct any import errors and re-process.

Successfully implementing a new process isn’t always easy. Consider the best practices below to streamline and control new process implementations.

System permissions and security functionality play a vital role in any SL process. Using these SL tools allows the user to set up efficient and controlled processes.

Common budgeting functionality, measures, and alerts examples are displayed in the tables below:

An accurate budget is the basis of effective business management. While the budgeting method, level of budget detail, and its complexity are dependent on company size or management style, it’s critical to be able to compare actual results against a known target in making informed business decisions.

No matter which preparation method or level of detail budget you choose, remember that some type of budgeting process is an important part of a well-run company.

A successful budget projects revenue and expense accurately, assist the company in maximizing profit, and keeps company team members aligned with the company’s goals. SL helps ensure budget success by offering a quality budget solution. SL budgeting is a strong management tool that should not be overlooked.

Reach out to our experts today if you are ready to start building a budget using Dynamics SL.

Talk to us about how Velosio can help you realize business value faster with end-to-end solutions and cloud services.