Cash Needs Forecasting

Cash forecasting helps orgs understand the cash effects of sales and expense variances, cash spending plans, or changes in cash reserves.

Cash forecasting helps orgs understand the cash effects of sales and expense variances, cash spending plans, or changes in cash reserves.

Table of Content

A cash forecast is used to monitor a company’s projected cash requirements for a specific period of time. Cash forecasting helps a company to understand the cash effects of sales and expense variances, changes in AP and AR activity, cash spending plans (e.g., capital spending), or changes in cash reserves.

Some companies complete the forecasts weekly or monthly. Other companies complete the forecast daily.

Larger companies may need more complicated forecast tools. There are a number of applications that focus on cash forecasting. For large businesses this can make sense as functionality such as, efficient multi-entry and multi-currency handling may be required. Additionally, some applications include enhanced collections functionality and the ability to prepare multiple forecast models.

However, for smaller companies, cash forecasts should be simple and easy to understand to be effective.

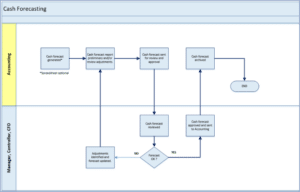

Measures and alerts are meant to assist the user in keeping abreast of processing status, identifying anomalies, and ensuring that implemented process controls are effectively employed. The information below illustrates the interaction between basic cash forecasting system functionality and measures and alerts.

Functionality- Financial Reporting, Budgeting and Forecasts

Measures and Alerts-

Just as strong financial budgeting and forecasting are crucial in controlling the company’s financial performance, they also play a critical role in supporting sound cash management.

Actual variances in revenue, gross profit and operating expenses when compared to the budget or forecast, can indicate conditions which can have a material impact on cash levels. Variances above a certain amount or percentage should be identified, and if needed, corrective actions taken.

Comparing actual results to the budget can be effective in the early part of an accounting year. A static budget though, is generally obsolete within the first month or two of the accounting year, once material actual to budget variances are encountered. At this point, the budget is no longer an accurate projector of future performance.

Using forecasting, however, allows the company to better understand the effect of sales, cost of sales and expense lines variances on cash levels.

To learn more about how forecasting can help your company, take a look at our post Replacing Budgets with Forecasts? Expect These Benefits.

Functionality- Fixed Assets

Measures and Alerts-

Variances in capital spending when compared to the budget or forecast can have a material impact on cash levels. Variances above a certain amount or percentage, as compared to budget or forecast, should be identified, and if needed, corrective actions taken.

To mitigate capital spending variance risks, build a capital budget by project or fixed asset class (for spending above a specific amount). Depending on the project (e.g., construction projects), more detailed budgets can be built as needed.

Finally, even if you build a capital budget, don’t forget to regularly review future period spending, especially when large amounts are required such as deposits, progress payments and similar transaction types, as the timing may change during the year.

Functionality- Banking

Measures and Alerts-

Bank transaction amounts above a specific amount should be identified and reviewed as a part of the cash forecast process. Transactions above a certain amount should be identified, and if needed, corrective actions taken, or adjustments prepared. Even if the transaction is correct, it may have been unexpected, and as such may have an impact on cash level expectations.

To better manage cash transactions, build a cash transaction schedule including transactions such as loan due dates and other scheduled payments. Don’t forget to regularly review future period obligations, especially when large amounts are involved as the timing may change during the year.

Functionality- Accounts Receivable (AR) and Accounts Payable (AP)

Measures and Alerts-

AR and AP activity play an important role in maintaining cash balances at the desired levels. In addition to the actual cash inflows and outflows, activity timing changes are very important.

Increases in AR outstanding invoices can have a negative impact on cash. Customer delinquencies reduce the amount of cash coming in.

Use AR measures and the customer AR aging report to identify the issues. When needed, increase collection activities to bring the AR aging back in line. Be sure that any AR aging changes are accounted for in the cash forecast.

AP invoice aging is another indicator of potential cash issues. Use AP measures and the AP invoice aging report to get an idea of future cash needs. For example, as AP invoice aging amounts move out from current to thirty, sixty or ninety days outstanding, the cash forecast needs to reflect any increased cash needs to cover the payments.

Sooner or later, the outstanding invoices will need to be paid. The invoice aging analysis is very important as the company needs to understand their obligations, and possibly secure a short-term loan or liquidate other assets to provide the funds required.

Successfully implementing a new process isn’t always easy. Consider the best practices below to streamline and control new process implementations.

System permissions and security functionality play an important part in any ERP process. Using these “feature rich” ERP tools, allow the user to set up efficient and controlled processes.

A common cash needs forecast permissions example is displayed in the table below:

| Screen | View | New | Edit | Delete |

| Functionality | ||||

| Accounting | ||||

| System report or spreadsheet generation | X | X | X | NA |

| Forecast version control | X | X | X | NA |

| Forecast adjustments data entry | X | X | X | NA |

| Manager, Controller or CFO | ||||

| Budget and/or forecast review and approval | X | NA | X | NA |

| Measures/ Alerts | ||||

| Accounting | ||||

| Cash needs forecast | X | NA | NA | NA |

| YTD profit and loss statement | X | NA | NA | NA |

| AP aging reports | X | NA | NA | NA |

| AR aging reports | X | NA | NA | NA |

| Manager, Controller or CFO | ||||

| Cash needs forecast | X | NA | NA | NA |

| Revenue variances of “N” dollars or “N” percent of budget or forecast. | X | NA | NA | NA |

| Cost of sales variances “N” dollars or “N” percent of budget or forecast. | X | NA | NA | NA |

| Departmental expense variances of “N” dollars or “N” percent of budget or forecast. | X | NA | NA | NA |

| Capital expenditure transactions in excess of “N” dollars. | X | NA | NA | NA |

| Bank transactions in excess of “N” dollars. | X | NA | NA | NA |

Careless and ineffective cash management plays havoc with a company’s operations. If issues are not quickly identified and addressed, things can quickly spiral out of control and end in disaster.

At this point, you may or may not have decided if cash needs forecasting and analysis is the way to go. Whether you use forecasts or not, be sure to have a tool in place to proactively control your cash position.

Stay within your company’s capabilities and be sure to get the most value from the level of effort you choose. Remember, “Cash is King”.

Talk to us about how Velosio can help you realize business value faster with end-to-end solutions and cloud services.