Top 5 Ways Businesses Can Collect Payments Faster in 2024

With iSolutions, you can collect payments faster thanks to automated and streamlined invoicing and collections features.

With iSolutions, you can collect payments faster thanks to automated and streamlined invoicing and collections features.

Table of Content

The ability to collect payments faster is more significant than ever. The economic landscape is increasingly volatile, with fluctuations in market conditions and currency values. This unpredictability makes it crucial for businesses to maintain a steady cash flow to ensure stability and resilience. Secondly, the rapid pace of technological advancements has raised customer expectations. Consumers now anticipate quick, seamless transactions, and this extends to payment processes. Businesses that are slow in collecting payments risk losing customer trust and loyalty.

Additionally, the competitive business environment demands operational efficiency. Faster payment collection improves liquidity, enabling companies to reinvest in growth opportunities, innovate, and stay ahead of competitors. Lastly, in an era where data is king, quicker payments mean faster access to financial data, allowing for more timely and informed business decisions.

Additionally, the competitive business environment demands operational efficiency. Faster payment collection improves liquidity, enabling companies to reinvest in growth opportunities, innovate, and stay ahead of competitors. Lastly, in an era where data is king, quicker payments mean faster access to financial data, allowing for more timely and informed business decisions.

Collecting payments faster is vital – but how do you make it happen? Today’s leading businesses rely on Dynamics 365 Business Central to manage their operations, but the system can fall short. That’s where iSolutions comes into play. With iSolutions, you can collect payments faster thanks to automated and streamlined invoicing and collections features.

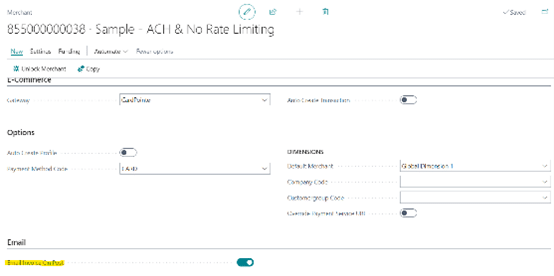

Setting up payment terms with your customers is key to rapid payment. Many businesses require credit card authorization prior to releasing a sales order. In this scenario, you have the ability to save a credit card profile for each of your customers which is automatically charged when a shipment to their account is posted. The payment is applied to the posted invoice.

In setup, you can specify to require a Credit Card Authorization prior to releasing a Sales Order based on Payment Terms Code.

Communication with your customers about upcoming payments, payments processed, and those in arrears is critical to collecting faster. Rather than manually sending out each of these updates to every customer, you can automate this process and enable the system to send information to your customers at the specific point you choose.

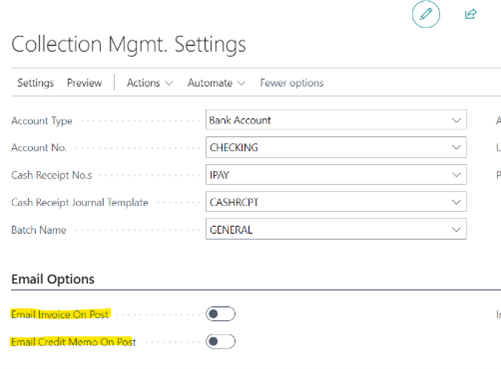

When you fulfill the order and charge your customer’s credit card, it’s important to inform them right away. Within iSolutions you can choose to automatically email the invoice or credit memo when a payment is posted, eliminating manual processes.

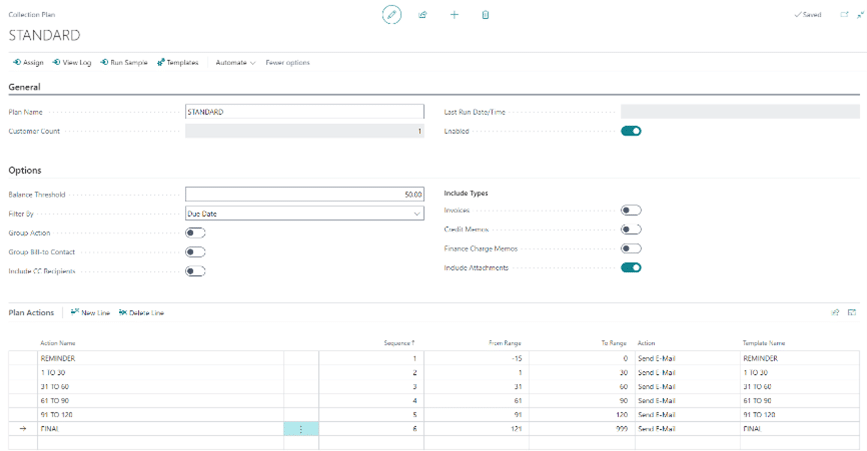

Collection Plans can be set up to send out reminders and late-notice emails to assigned customers. You can set up different language and messaging based on how Past Due the customer is. You can also set up multiple Collection Plans to assign to different customers based on Actions and Templates.

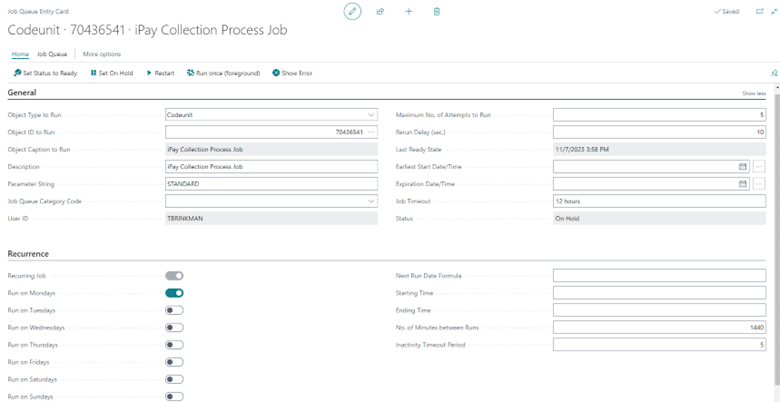

The Business Central Job Queue will schedule the Collection Plan to run as needed with no manual effort required

Each Collection Plan is set up in the Job Queue to run on the day(s) scheduled by entering the Collection Plan Name in the Parameter String.

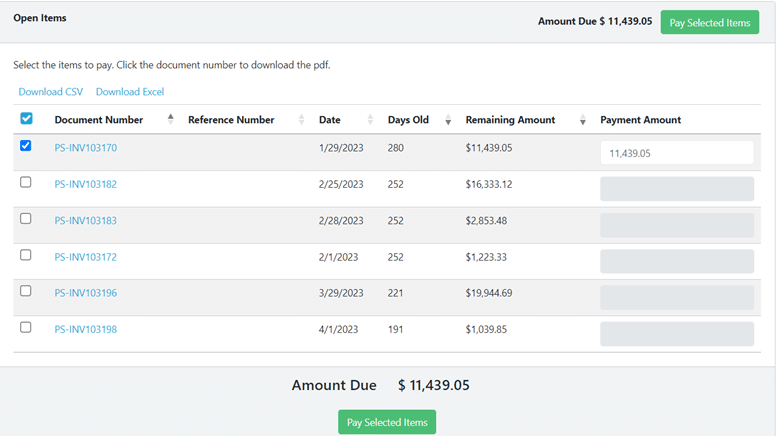

Every customer has their own preferred payment type. Being able to accept and process each will subsequently speed up your time to payment. Choose a solution that will allow you to record all types of payments – credit card, ACH, cash, check, and wire – all in a single place. With iPayment, you can process and record all point-of-sale payment types.

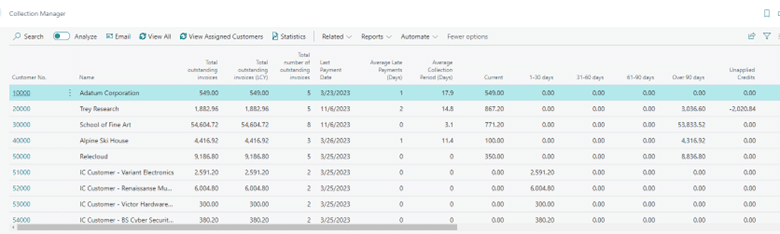

With Business Central and iPayments, you can monitor outstanding invoices and review Average Collection Days and Late Payments, allowing you not only to see those customers who already have late invoices but also predict late payments before they happen.

With a view of all customers with outstanding balances, you can automatically email PDF copies of all outstanding invoices to selected Customers.

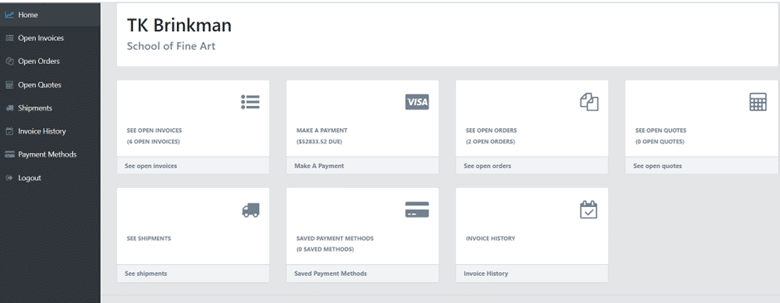

Online portals are no longer optional, they’re expected by your customers. An easy-to-use portal helps you better communicate with customers and makes it fast and easy for them to make payments when required. With the portal from iSolutions, your customers can create their own profile, set up their own payment method (credit card or ACH), and view open quotes, orders, shipments, and invoices. And most importantly – make secure payments. They also have access to view their invoice history.

Not only does a portal help speed up the payment process, but also can help drive additional sales. Customers can refer to prior orders and reorder, evaluate quantities ordered, and much more.

The importance of accelerating payment collection in 2024 cannot be overstated. In a rapidly evolving economic landscape, swift payment processes are no longer a luxury but a necessity for businesses. By embracing faster payment methods, companies can bolster their cash flow, meet the high expectations of a tech-savvy customer base, and stay competitive. Ultimately, the ability to collect payments efficiently is a pivotal factor that will define the success and resilience of businesses.

Learn more about how Dynamics 365 and iSolutions can help you process payments faster. Reach out to the experts at Velosio. Our team helps businesses run more efficiently using the best technology solutions available.

Talk to us about how Velosio can help you realize business value faster with end-to-end solutions and cloud services.