AP Invoice Entry Use ERP Accounts Payable Functionality to Streamline AP Invoice Entry

An organized and effective vendor invoice entry and logging process is critical to efficient and accurate Accounts Payable processing.

Table of Content

Accounts Payable (AP) operates in a demanding environment. The volume of AP transactions is substantial, and the payables processing cycle can be difficult to complete, as AP interacts with nearly every department in the company as well as with outside vendors. To successfully meet its processing goals, AP must rely on both streamlined and sound processes. If these goals are not met, the result is unhappy vendors which cause rushed processing and of course the attendant processing errors.

AP’s inability to process transactions in an effective manner can be traced to specific reasons such as out-of-date procedures, poor review and approval processes, inadequate executive support and not using the current ERP to its full capabilities.

In today’s SMB marketplace there are several AP specific applications designed to automate AP invoice entry, distribution and approvals. Overall, the application functionality is satisfactory, and can make a positive impact in AP invoice processing. However, like everything else, there is a price to be paid for these improvements.

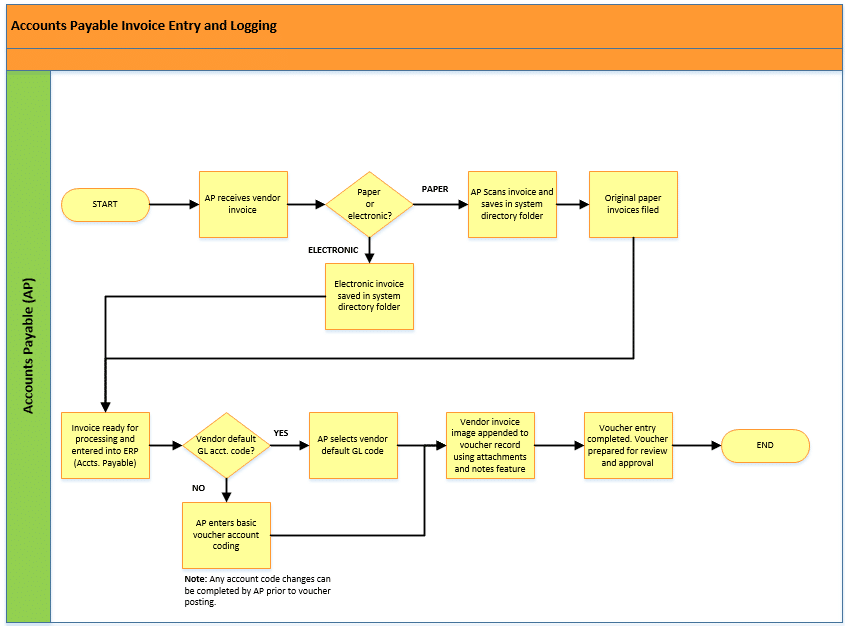

Invoice receipt and logging processes vary greatly between companies. Most of the time, invoice receipt and logging tasks are based on legacy processes which have been used for several years. For example, many companies put incoming paper invoices into folders. Invoices may be sorted by vendor, due date or both. AP may or may not maintain some sort of received invoice log. Electronic invoices are printed and handled in the same manner. Using these old-fashioned filing and logging methods cause invoices to be misplaced or lost making open invoice search and processing difficult. Instead, let your ERP do the invoice logging for you.

A better way to receive and log vendor invoices is to enter them into the ERP as soon as they are received and use the ERP as a logging tool. Since the ERP tracks invoice information such as vendor, invoice date, discount date and due date entering the invoices into the ERP can streamline the invoice entry and logging process.

Invoice entry is controlled using process status levels (e.g., unposted, posted). Some ERPs provide additional levels. No matter how the levels are structured, the invoice entry process only affects the financials when the transaction is posted.

To streamline the subsequent invoice review and approval process, the invoice itself can be scanned and attached to the applicable voucher, using the voucher screen’s notes and attachments feature, as a part of the data entry and logging process. Electronic invoice records can be attached in the same manner.

It’s a fairly easy task to generate AP reporting to display voucher transactions entered and saved in an unposted status. The unposted vouchers displayed should reconcile to the invoices entered. Using basic ERP reporting features such as filtering, sorting and search, invoices received and entered should be easily determined.

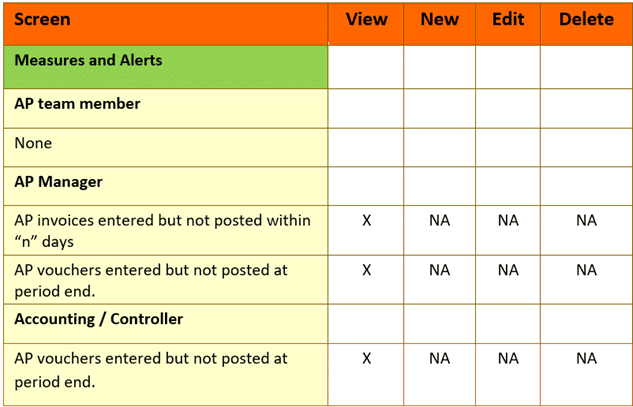

Measures and alerts are meant to assist the user in keeping abreast of processing status, identifying anomalies, and ensuring that implemented process controls are being effectively employed. The information below illustrates the interactions between AP invoice entry and tracking functionality, measures and alerts.

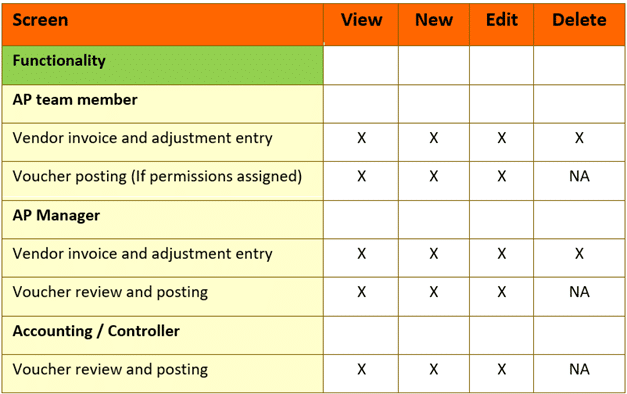

Functionality- ERP Accounts Payable invoice entry

Measures and Alerts-

AP invoices entered but not posted within “n” days

Entering an AP invoice is the first step in AP processing. After entering, the invoice needs to be reviewed, approved and coded to the correct GL accounts. After these processes are completed, the transaction is recorded into the GL by posting the voucher.

Use the AP invoices entered but not posted measure and alert to be sure that voucher posting is not delayed. Investigate any vouchers not posted within the defined number of days to identify any invoice approval issues or other approval and processing backlogs.

Functionality- ERP Accounts Payable voucher posting

Measures and Alerts-

Accounts Payable vouchers entered but not posted at period end

At first glance, this measure and alert would seem to be same as that described above. While the concept is the same, reviewing unposted vouchers at the end of an accounting period plays a vital role in the AP period close process. The key to accurate financial reporting is ensuring that all the period’s associated transactions are accounted for and posted. Use the AP vouchers entered but not posted at period end measure and alert to identify any AP period close issues and/or the need to process any period close expense accruals.

For additional insight into the AP period close process. See: AP period close

Successfully implementing a new process isn’t always easy. Consider the best practices below to streamline and control new process implementations.

System permissions and security functionality play a vital role in any ERP process. Using these ERP tools allows the user to set up efficient and controlled processes. Common AP period close functionality, measures and alerts examples are displayed in the tables below:

An organized and effective vendor invoice entry and logging process is critical to efficient and accurate AP processing. To successfully meet its processing goals, AP must rely on both streamlined processing and sound controls.

Use the functionality, best practices, measures and alerts described here to avoid unhappy vendors, rushed processing and considerably reduce the number of AP processing errors.