Financial Forecasting: Why Budgets May Not Be Enough

Explore accounting year forecasting in this post, and learn how financial forecasting can improve company profitability.

Explore accounting year forecasting in this post, and learn how financial forecasting can improve company profitability.

Table of Content

In our How to Build and Maintain an Effective Budget post, we discussed how to build a budget using your ERP’s budgeting functionality combined with Excel worksheet templates and ERP file import.

Most companies today prepare some sort of financial budget. Budgets can be built at a very high level (Sales, cost of sales and expenses), or built in detail (sales detail by type, expenses by department, capital spending, projects). Some companies also budget the Balance Sheet to be able to prepare budgeted cash flow statements.

Budget preparation is an important task and, in most companies, represents a large investment in time and effort. A de-centralized budget involves nearly all of the company’s management team from the department manager to the senior executives.

The problem with a budget is that it’s static information. A budget can be pretty much obsolete within the first month or two of the new accounting year, making the return on the company’s budget preparation time and resource investment minimal at best.

A successful budget is one which meets four objectives:

With an annual (or even semi-annual) budget cycle, meeting these objectives is almost an impossible task. Some companies get around budgeting weaknesses by using a rolling forecast.

A rolling forecast is a financial projection that is periodically adjusted (usually monthly) based on actual business results and other factors.

ERP-built rolling forecasts use a number of different ERP tools such as budget functionality, multiple budgets, file import and export, advanced report writers and sometimes Excel spreadsheets.

Rolling forecasts can be based on different calendarization methods. Some forecasts are based on the accounting year (calendar or fiscal). For example, in a calendar year accounting environment, a forecast takes effect in the second period (February) and is re-forecasted until the end of the accounting year (December).

While forecasts can also be built by looking forward a specified number of periods regardless of the accounting year, for the purposes of this post, we’ll be discussing accounting year forecasting.

In a rolling forecast, each accounting period’s budget or forecast value is replaced with actual values at the end of each period. For example, an April forecast, after the March period close (in a calendar-based accounting year), budget and forecast values for January through March are replaced with actual financial results. April through December periods would be the original budget or re-forecasted values. When the April forecast is completed, the full-year forecast includes January-March actuals and an April to December forecast or re-forecast.

A rolling forecast utilizes a number of the processes and techniques used in budgeting. The main differences relate to the information selected to appear in forecast reporting. Using the example information above, the April financial forecast report would include 3 monthly columns of actual results, and nine monthly columns of forecast values.

If your report writer can’t handle this, you can always download the data to an Excel workbook and complete the reporting that way.

It’s pretty easy to see how the forecast is a much more accurate predictor of future performance.

Learn more about financial forecasting including forward-looking forecasts,

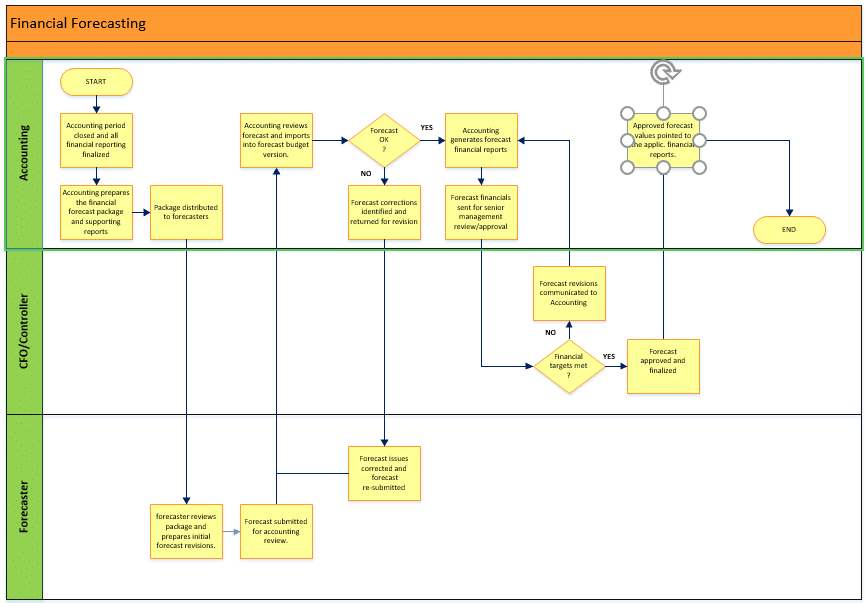

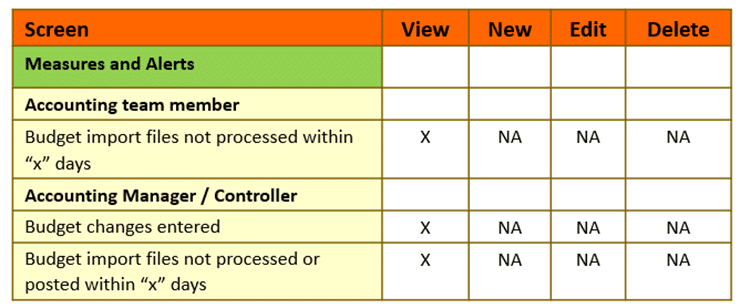

Measures and alerts are meant to assist the user in keeping abreast of processing status, identifying anomalies, and ensuring that implemented process controls are being effectively employed. The information below illustrates the interaction between financial forecast-related budget functionality, measures and alerts.

Functionality- ERP multiple budget versions

Measures and Alerts-

Budget version changes entered

New budget versions set up

Existing budget versions disabled or deleted

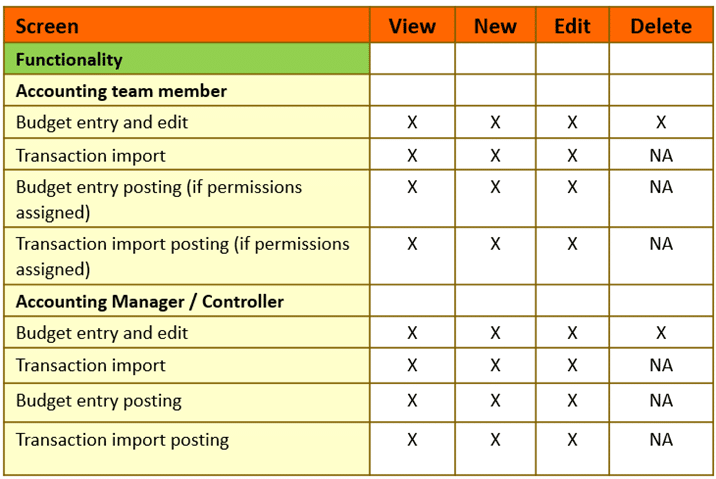

Today, all ERPs support building roles and permissions to control budget version set up and change transaction processing. With proper permissions assigned, a user can copy a budget, rename it to a different version, and edit the new version’s budget values. Budget version control and change functionality should be tightly controlled within the accounting department. If not controlled properly, financial forecast accuracy will be negatively affected, and if significant, can render the forecast useless as an analysis tool.

For an adequate level of control, assign budget permissions, which affect financial forecasting, to a limited number of accounting users such as a senior accountant, accounting manager or the controller. Some companies have a dedicated financial reporting and analysis department. If so, assign the permissions accordingly. Assign one user as the primary user, and the others as backups.

Any new forecast budget versions are no different than any other budget, the only difference being that the term relates to a budget version which has been edited for use as the original budget’s replacement and financial forecasting tool. In building accurate forecasts, using the correct budget version is essential, so any new forecast budget versions built should be reviewed and their purpose in the forecasting process documented.

Existing budget versions can be deleted or set to an inactive status. Again, these budget version changes should be reviewed and documented as to their ongoing purpose in the financial forecast process.

Functionality- ERP file import

Measures and Alerts-

Budget import files not processed within “x” days

Budget import files not processed or posted within “x” days

Many companies use a set of prepared Excel worksheet templates in preparing the financial forecast files. This is an effective method when non-accounting users participate in the forecasting process. Being able to use Excel functionality, and not having to worry about understanding ERP budget functionality, simplifies the forecast process.

Using the same techniques, and probably the same worksheet templates as employed in the budgeting process, financial forecasting worksheets can be built by specific departments (e.g., HR, Payroll) and non-department budget types (e.g., sales, cost of sales or depreciation expense). Using the worksheet templates allows accounting to control the GL accounts available to the forecaster.

Many budget import processes are based on a two-step approach (import processing and import posting). This approach means that when a budget file is imported into the ERP, correct data is imported, incorrect data is rejected and identified by the import tool then displayed for the user to correct and re-process.

Once the imported data is correct, the user finalizes or “posts” the applicable data.

Use import functionality reporting to control the import process. By identifying financial forecast files not yet imported (as manually compared to an import control worksheet) accounting can follow up with the applicable forecasters and resolve any issues.

By identifying financial forecast files imported but not yet posted, accounting can follow up with the applicable forecasters to correct any import errors and re-process.

As a side note, if the forecast changes are not extensive, it may be easier to manually enter the budget changes into the ERP.

Successfully implementing a new process isn’t always easy. Consider the best practices below to streamline and control new process implementations.

System permissions and security functionality play a vital role in any ERP process. Using these ERP tools allows the user to set up efficient and controlled processes.

Since financial forecasting uses budgeting functionality, budgeting functionality, measures and alerts examples are displayed in the tables below:

After reviewing this post, you may or may not have decided if a rolling forecast process is the way to go. No matter the method you choose, budgeting or forecasting, remember that some type of financial planning process is a vital part of a well-run company.

A quality budget or forecast is a very strong management tool and should not be overlooked, or the process short-cut. With a considerable number of successful implementations under our belt, you can be confident that we have the tools and experience you are looking for. Reach out to our experts today.